Wage Calculator Tax And Ni

You can compare different salaries to see the difference too. Find out your take-home pay - MSE.

The simple NIPAYE calculator allows you to calculate PAYENI on the salary that you pay yourself out of your limited company.

Wage calculator tax and ni. This calculator allows you to enter you monthly income for each month throughout the tax year. Hourly rates weekly pay and bonuses are also catered for. This handy calculator will show you how much income tax and National Insurance youll pay in the 2020-21 and 2021-22 tax years as well as how much of your salary youll take home.

This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202122. Enter your Salary and click Calculate to see how much Tax youll need to Pay. The calculator needs some information from you before working out your tax and National Insurance.

Youll pay 2 NI on the earnings above 50000. If you have more than one job use the calculator once for each job. Youll pay 12 NI on the earnings between 9500 and 50000.

Now lets simulate a salary calculation for a yearly gross income of 45000. The latest budget information from April 2021 is used to show you exactly what you need to know. Calculate how much interest is due on a payment of Inheritance Tax Inheritance Tax residence nil rate band RNRB calculator Calculate the RNRB if a home is left to direct descendants.

The calculator assumes the bonus is a one-off amount within the tax year you select. The UK PAYE tax calculator salary calculator is active since 1998. You can compare different salaries to see the difference too.

This tells you your take-home pay if. Youll pay 0 in National Insurance at. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Give it a go. The most recent rates and bands from HMRC inland revenue.

Now includes part time. This simple tool calculates tax paid and national insurance contributions. It is important to understand that National Insurance is calculated on the period you are paid.

Then enter your annual income and outgoings from self-employment. Updated for tax year 2021-2022. 10000 20000 30000 40000 50000 60000 70000 80000.

If you have other deductions such as student loans you can set those by using the more options button. Income Tax and National Insurance you can expect to pay for the current tax year. We are happy to be considered as the number one calculator on the internet for calculating earnings proving an invaluable tool alongside any small business accounting solution or corporate payroll software.

Broadwing Employment Agency is offering a free tool to. So in this calculator which uses monthly payment payroll process National insurance is calculated. Salary for pay Period.

All you need to do is enter your regular salary details and then enter the amount of the bonus. Our tax calculator uses tax information from the tax year 2014 2015 to show you take-home pay if you need to see details of PAYE and NI for a different year please use our advanced options. Your tax code age and other options might also affect your calculations.

Use our salary calculator to check any salary after tax national insurance and other deductions. The reedcouk Tax Calculator calculates how much Income Tax also known as PAYE and National Insurance NI will be taken from your salary per week per month and per year. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

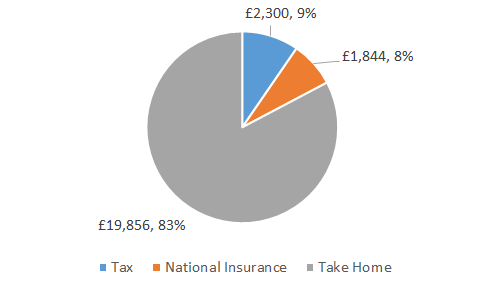

The calculator then provides monthly PAYE and NI deductions and an annual figure overview of deductions so you can review monthly amounts and annual averages for standard payroll deductions. Wage calculator ni The latest budget information. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

Configurable allowances include the option to select no national insurance. Enter your salary below to view tax deductions and take home pay and figure out exactly how much money youre left with at the end of the month. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more.

Hourly rates weekly pay and bonuses are also catered for. To change this value to your actual salary scroll up and add it to the main input field at the top of the page. Why not find your dream salary too.

14 lignes 30500 of your earnings qualify for the 12 rate NI. Just enter in your salary and find out how much income tax and National Insurance youll pay. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

5 lignes The Malta Salary Tax Calculator. The latest budget information from April 2021 is used to show you exactly what you need to know. Firstly you need to enter the annual salary that you receive from your employment and if applicable any overtime or pension details.

Why not find your dream salary too. If you are not calculating a real payroll but want some rough.

Contractor Salary Choosing A Tax Efficient Salary In 2021 22

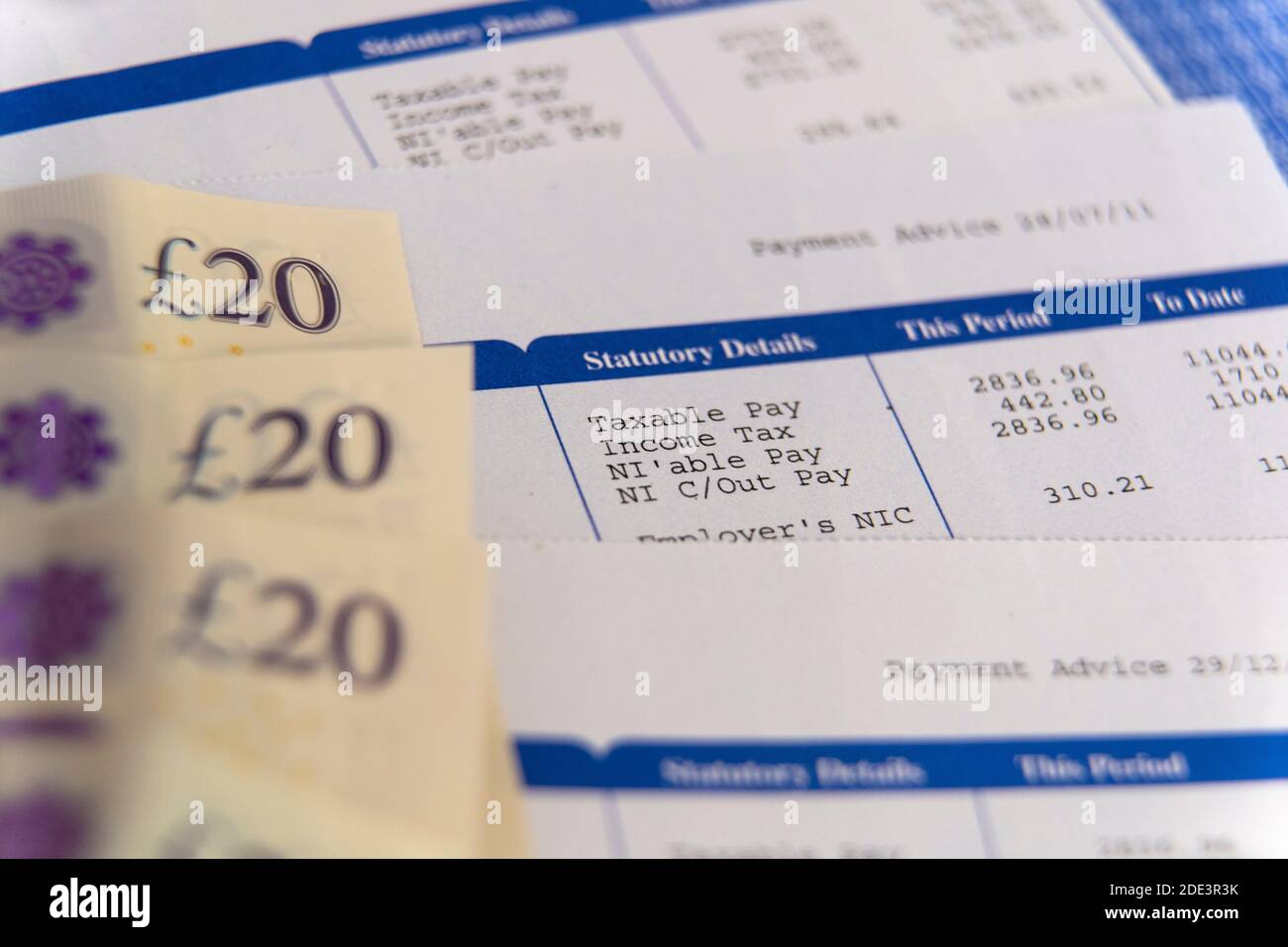

Pay Slip Wage Packet Salary Tax And Deductions Salaries Stock Photo Alamy

Do You Want To Hire Best Chartered Accountants In Croydon Let Me Help You In This Regard Make More Money Mortgage Info Payroll

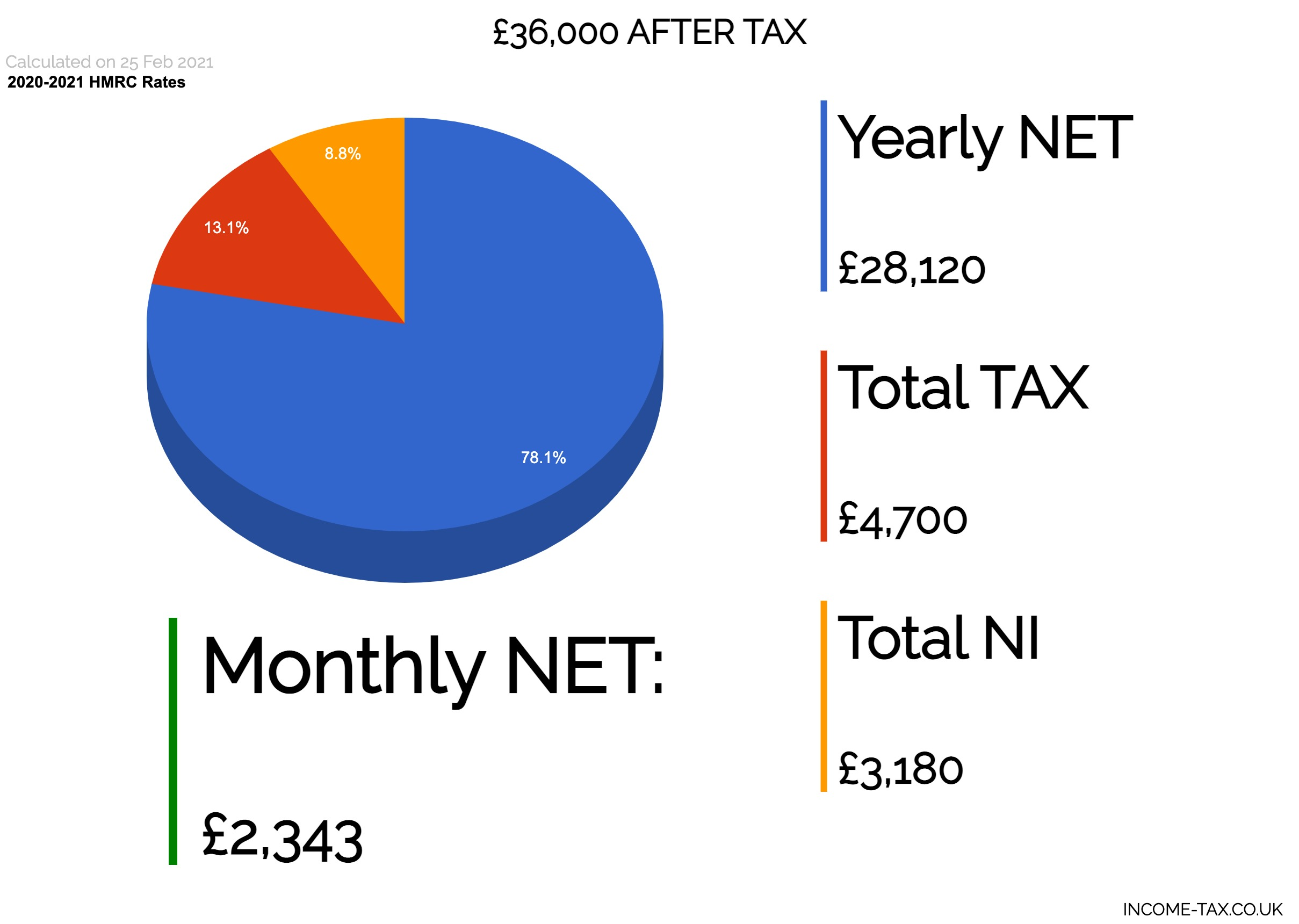

50 000 After Tax 2021 Income Tax Uk

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

Page 2 Payslip High Resolution Stock Photography And Images Alamy

France Salary Calculator 2021 22

How To Sell Online Payslips To Your Employees Payroll Things To Sell Payslip Template

Understand Uk S Tax Code In Your Payslips Coding Code Meaning Letters And Numbers

How Is Tax Calculated Explained Example Rates Simplified 2018 Calculator

Uk Salary Calculator Template Spreadsheet Eexcel Ltd

Uk Paye Tax And Ni Tables Tutorial 1 Free Pay Using Pay Adjustment Tables And A Calculator Youtube

60 000 After Tax After Tax Calculator 2019

Tax Ni And Net Pay Calculator After Tax Calculator

Income Tax Co Uk Uk Tax Calculator Posts Facebook

How To Calculate Your Income Tax And National Insurance Contributions Youtube

Post a Comment for "Wage Calculator Tax And Ni"