Gross Salary Uk Net

If your salary is 45000 a year youll take home 2853 every month. The amount of tax that you pay is not based on your earnings as an individual but on your earnings as a household.

Net Income Graphed As A Function Of Pre Tax Gross Income Personal Finance Money Stack Exchange

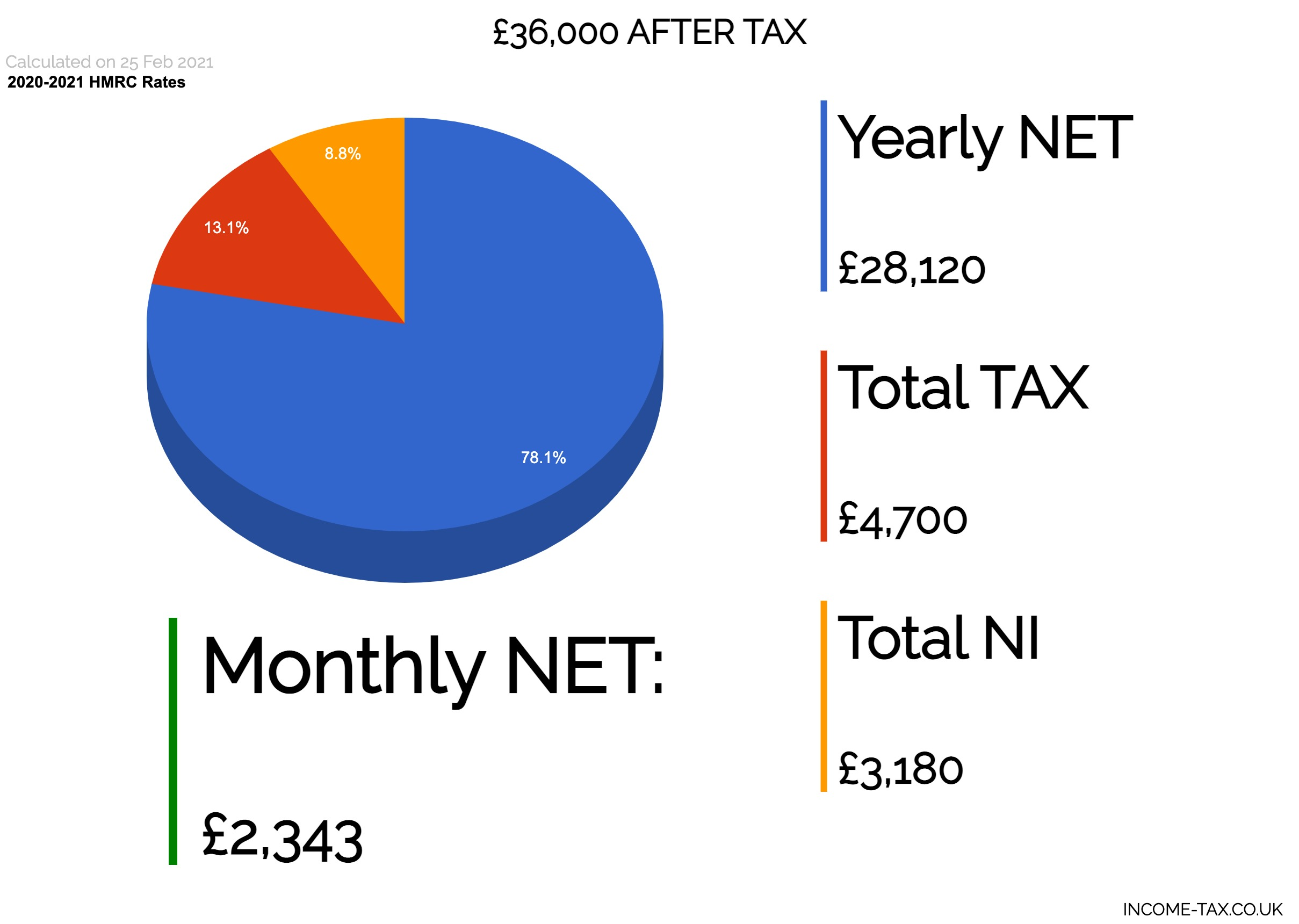

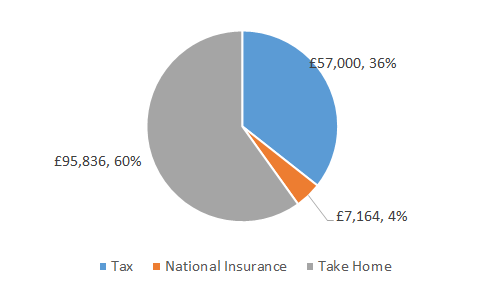

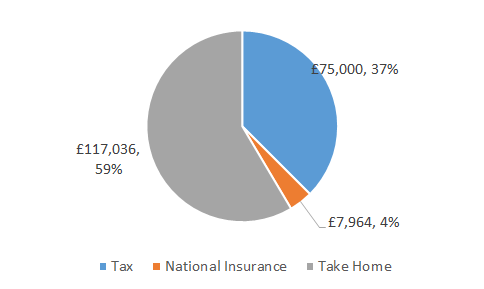

Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240.

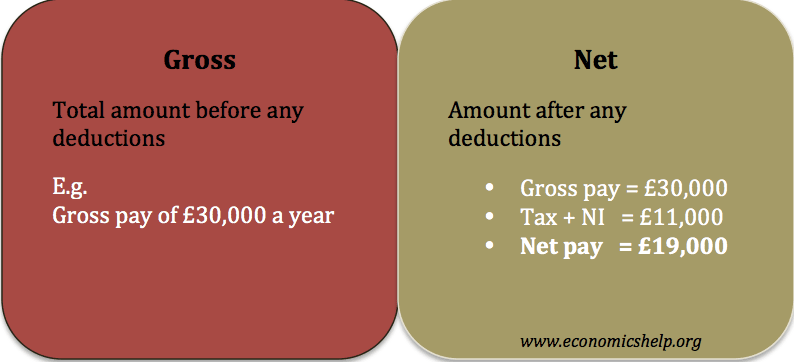

Gross salary uk net. But an employee owes HMRC a chunk of their salary for both income tax and national insurance contributions. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Gross salary is the total salary an employer has contractually agreed to pay an employee.

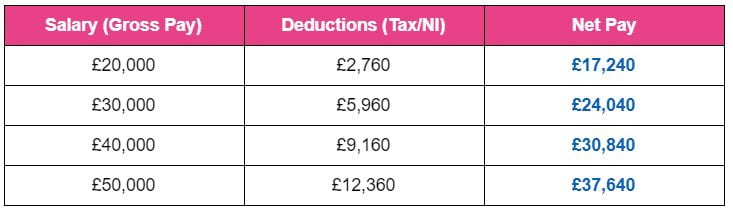

What is the Average UK Income. The gap between your gross pay and net pay is the deductions. The latest budget information from April 2021 is used to show you exactly what you need to know.

Net is the workers take home wage the amount of money which actually goes into their bank account Gross is the amount before any reductions such as income tax national insurance contributions and student loans Unfortunately at the moment. Extrapolating from the RecruitmentBuzz figures we calculate the salary that allows this level of saving in the UK is 35000 or 27400 after tax and this assumes the individual is not prey to lifestyle creep or lifestyle inflation. 21 lignes Gross Annual Net Monthly Gross Annual Net Monthly Gross Annual Net Monthly Gross.

1 2019 4451 2740 3568 Azerbaijan 591 712. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Your gross hourly rate will be 2163 if youre working 40 hours per week.

Gross Wage Net Pay 201920 Net Pay 202021 Difference. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Half of the population earns less than this figure and.

For instance if you normally earn 1200 while 350 is taken as deductions then your gross pay will be 1200 and the net pay will be 850. Self-employed workers employers fishermen and people working and living in a religious community are not affected by the minimum wage. 2020-Q1 429 356 1102 Armenia 164615 228342.

Why not find your dream salary too. Net PPP in Net Gross Gross Net Amount Albania. How to use our Tax Calculator.

There are interesting figures to be found here for example. 21 lignes Your net wage is found by deducting all the necessary taxes from the gross salary. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button.

Estimating the average household budget in the UK expenditure is around 500 per week. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. This is based on Income Tax National Insurance and Student Loan information from April 2021.

More information on tax rates here. For someone under the age of 30 this would require a salary of over 31000 per year. As of April 1 2021 the UK minimum wage for employees over 23 is 891hour gross - or around 1047hour gross.

This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual. Use the calculator to work out what your employee will take home from a gross wage agreement. Net salary is calculated when income tax and national insurance contributions have been deducted from the.

Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear. Hourly rates weekly pay and bonuses are also catered for. 2020-12 359 259 1059 Austria.

Use the calculator to work out an approximate gross wage from what your employee wants to take home. Please see the table below for a more detailed break-down. 2020-03 355 295 1221 Belarus.

Its equivalent to gross pay minus all mandatory deductions. Low income earners salary less than 10084 EUR do not pay income tax but after this amount the tax grows until 45 for individuals who earn more than 158222 EUR. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own.

The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made.

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

105 000 After Tax Isgoodsalary

Average Salary In Italy By Region Statista

Chart How Much Pay Makes You A Top Earner In The Uk Statista

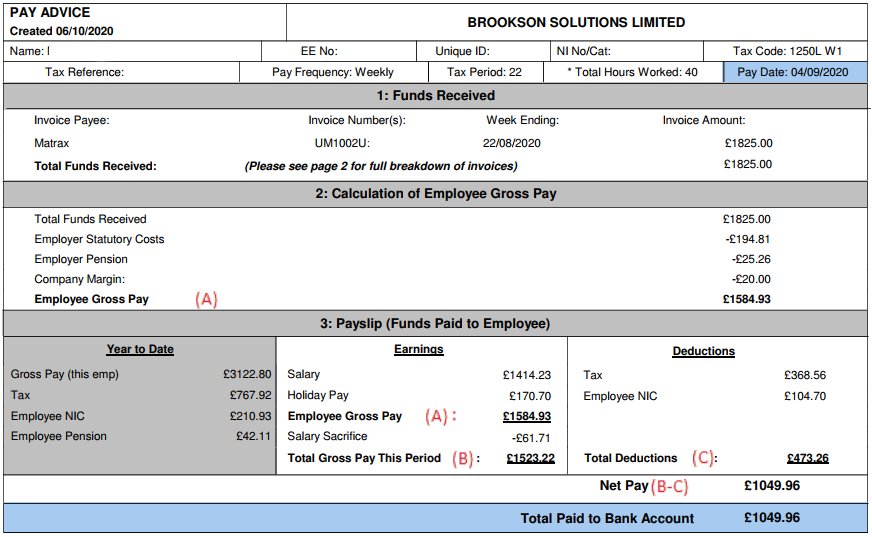

Your Umbrella Payslip Explained Brookson Faq

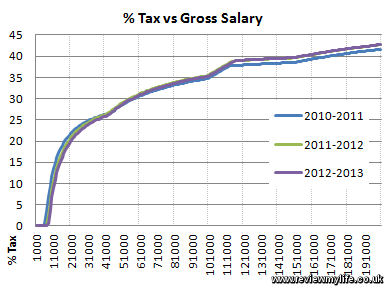

2012 2013 Uk Tax Graphs For Income Tax And Ni

1 560 A Month After Tax Uk July 2021 Incomeaftertax Com

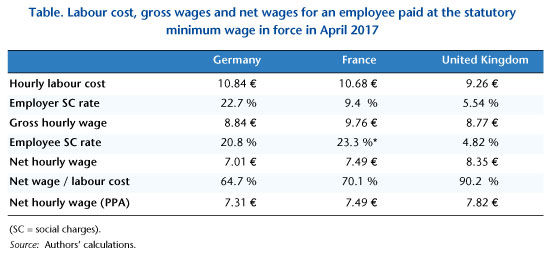

The Minimum Wage From Labour Costs To Living Standards Comparing France Germany And The Uk Ofce Le Blog

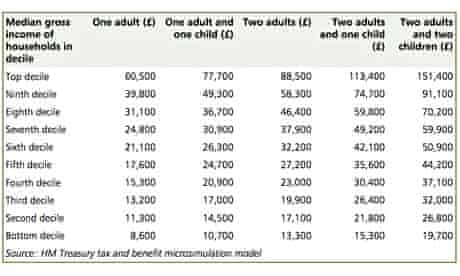

Uk Incomes How Does Your Salary Compare Pay The Guardian

Net Income Graphed As A Function Of Pre Tax Gross Income Personal Finance Money Stack Exchange

Comparison Of Uk And Usa Take Home The Salary Calculator

32 750 After Tax After Tax Calculator 2019

The Difference Between Gross And Net Pay Economics Help

50 000 After Tax 2021 Income Tax Uk

Comparison Of Uk And Usa Take Home The Salary Calculator

Post a Comment for "Gross Salary Uk Net"