Salary Calculator Gross Up

Add up all federal state and local tax rates. Use the calculator to work out an approximate gross wage from what your employee wants to take home.

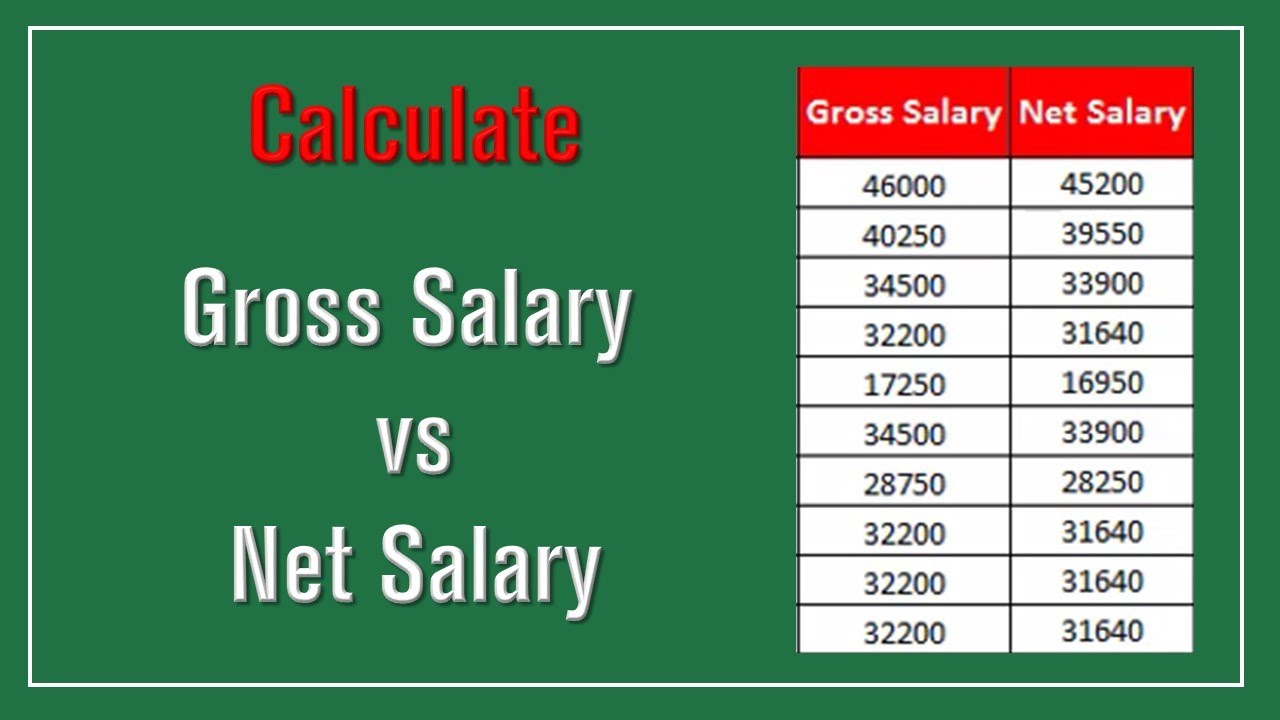

Gross Pay And Net Pay What S The Difference Paycheckcity

It also changes your tax code.

Salary calculator gross up. 1 tax net percent. Net interest 100 divided by 1-020 080 The tax is charged on the gross amount of 125 x 20 25 tax. The Konnekt salary and tax calculator is a new simple tool that gives you a comprehensive overview of your salary while employed in Malta.

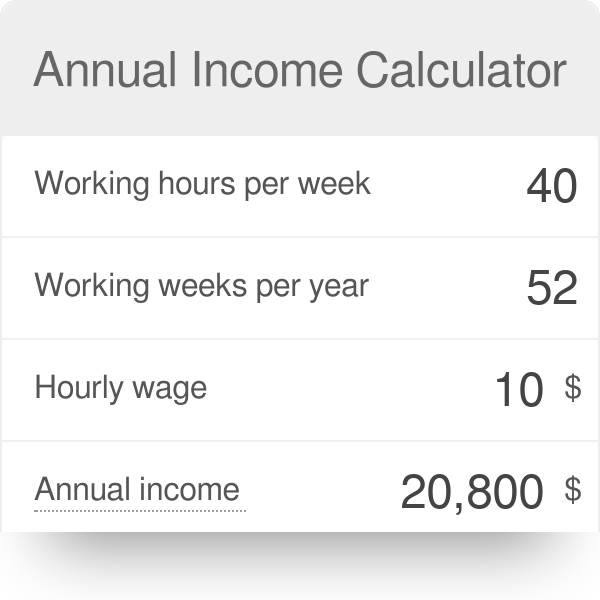

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. Take Home Pay Week.

The calculation is not to multiply by 1 tax rate. This reduces the amount of PAYE you pay. You can calculate your salary on a daily weekly or monthly basis.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Please click here to see the impact of the Monthly Income Tax Stamp Tax Cumulative Tax Basis Minimum Living Allowance etc.

Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Check your answer by calculating gross payment to net payment. Important Note on Calculator.

30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Enter your monthly or annual gross salary and the rest is done automatically. You can calculate your salary on a net salary basis by using the Net to Gross Salary Calculator we provide.

All bi-weekly semi-monthly monthly and quarterly figures. This way if you indicate 48 weeks you will necessarily have a higher periodic salary than if you indicate 52 weeks. Salary Before Tax your total earnings before any taxes have been deducted.

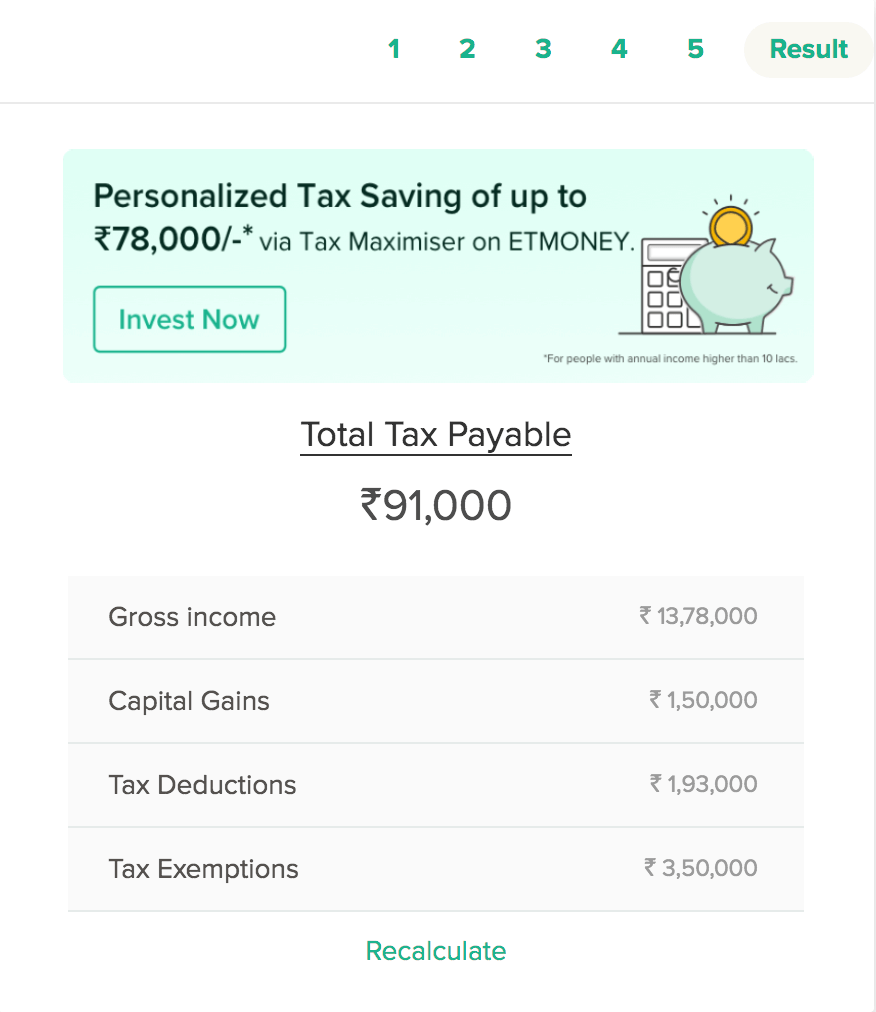

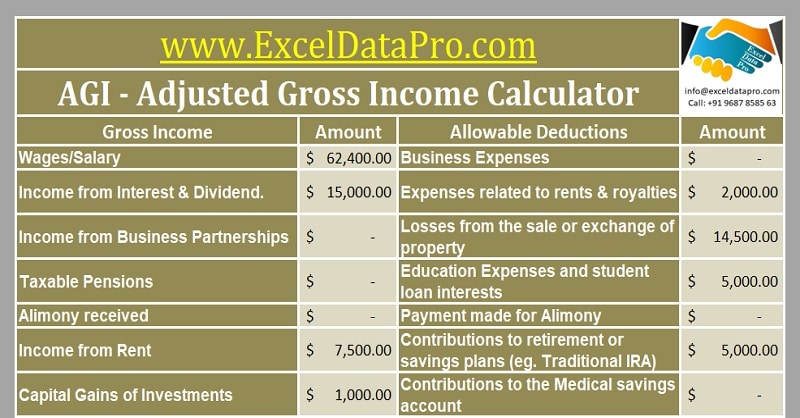

Use this calculator to quickly estimate how much tax you will need to pay on your income. California Gross-Up Calculator Results Below are your California salary paycheck results. It takes into account a number of factors such as tax rates in Malta Social Security SSCNI contributions and government bonuses.

To calculate tax gross-up follow these four steps. Net payment net percent gross payment. Using an estimation system to take into consideration every option available on the regular tax calculator.

It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount. If you dont qualify for this tax credit you can turn this off under the IETC settings. This tool lets you calculate how much tax and social insurance contributions are deducted from your salary when working in Cyprus.

Divide the net payment by the net percent. This tool should only be used as a guide to what deductions to expect. Use this federal gross pay calculator to gross up wages based on net pay.

Take Home Pay Gross. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

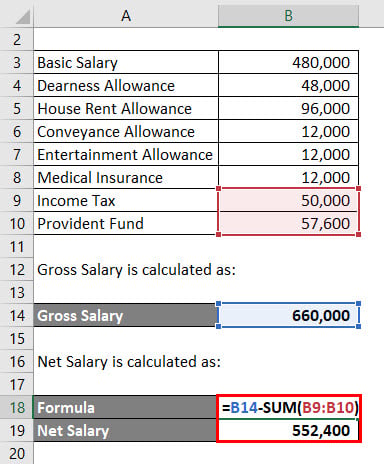

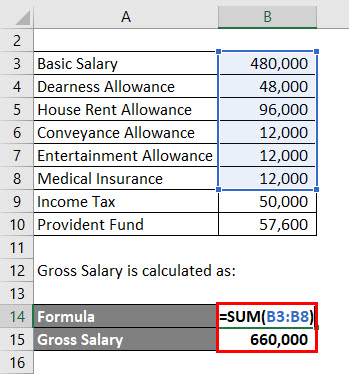

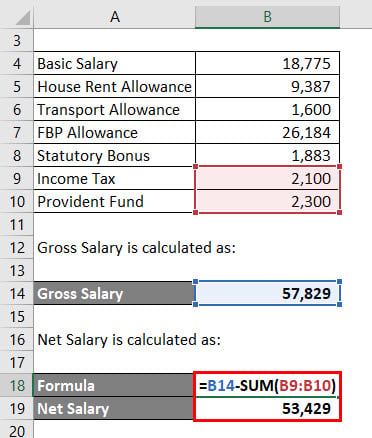

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. The adjusted annual salary can be calculated as. Enter the yearly gross salary and percentage of basic salary HRA dearness allowance DA conveyance allowance medical allowance special allowance professional tax and bonus the net salary calculator tool will automatically fetch you the detailed salary breakup and net salary amounts.

The answer is to use this tool our Reverse Tax Calculator. This is why the calculation is to DIVIDE BY 1 tax rate to give the right answer of 100 1 020 125. Most jobs are advertised with a gross salary amount and our tax calculator will be able to tell you exactly what to expect to take home but what if you know how much you needwant to satisfy your budget.

How do you find the gross salary from the actual money you need to spend. The results are broken up into three sections. Of Years of Service.

Net to Gross Salary Calculator At Stafftax we strongly advocate discussing and agreeing salaries in gross terms. Gratuity Basic salary Dearness allowance 1526 No. It can be used for the 201314 to 202021 income years.

Even though we try to make sure that all the values used in the calculation are up to date we cannot. Also known as Gross Income. 4 steps to gross-up payroll.

Our calculator allows you to evaluate the grossnet salary over the period based on the number of weeks worked that you entered in the field weeks of work. Gross Salary Cost to Company CTC - Employers PF Contribution EPF - Gratuity Gratuity calculation. Subtract the total tax rates from the number 1.

Youll then get a breakdown of your total tax liability and take-home pay.

Gross Pay And Net Pay What S The Difference Paycheckcity

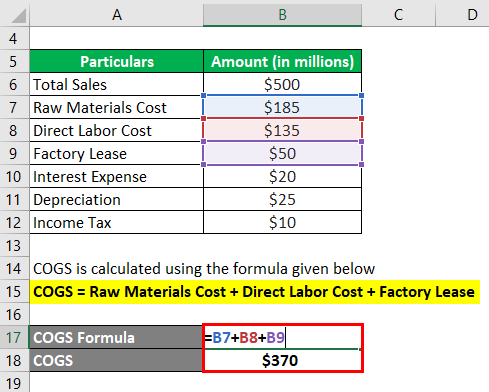

Salary Formula Calculate Salary Calculator Excel Template

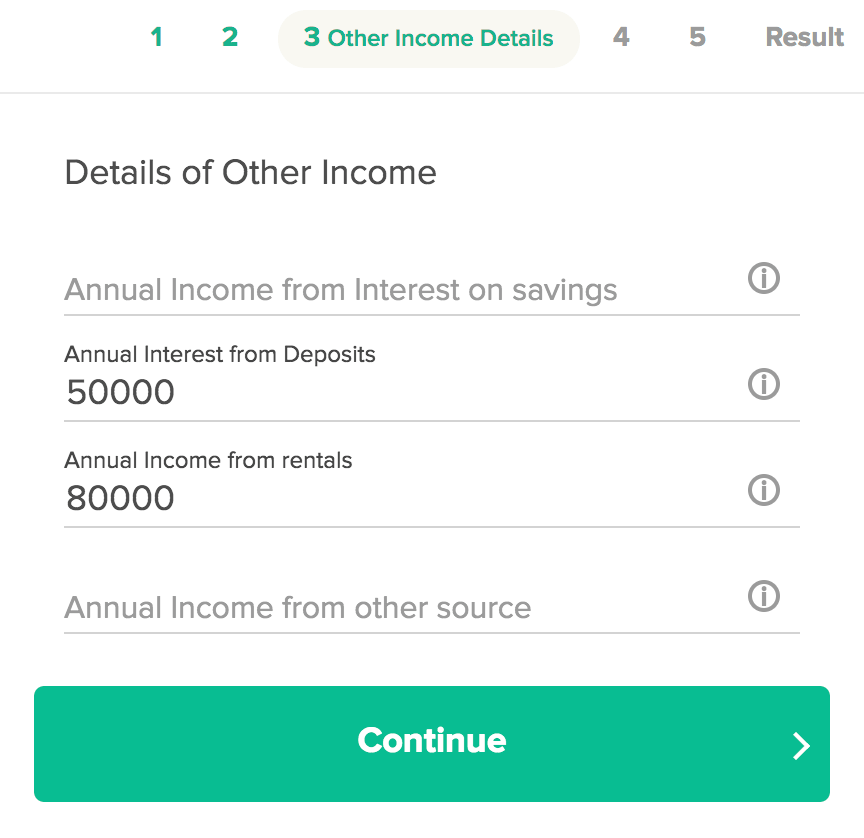

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Salary Calculator Statistics Explained

Paycheck Calculator Take Home Pay Calculator

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculator Statistics Explained

Avanti Gross Salary Calculator

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Paycheck Calculator Take Home Pay Calculator

Gross Income Formula Calculator Examples With Excel Template

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Net Pay Calculator Calculate Salary Before Taxes

Salary Calculator Statistics Explained

Gross Annual Income Calculator

How To Calculate Net Salary Gross Salary In Excel Youtube

What Is Gross Salary How To Calculate Gross Salary

Post a Comment for "Salary Calculator Gross Up"