Wage Calculator Ct

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Connecticut. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

Connecticut Paycheck Calculator Smartasset

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Wage calculator ct. The federal minimum wage is 725 per hour and the Connecticut state minimum wage is 1300 per hour. 23 lignes Living Wage Calculation for Hartford County Connecticut. Use our calculator to discover the Connecticut Minimum Wage.

This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. Line F 10 Temporary Wage Subsidy for Employers reduction. Connecticut Hourly Paycheck Calculator Results Below are your Connecticut salary paycheck results.

Welcome to the Connecticut Wage Calculator. Monthly Connecticut Withholding Calculator - CT-W4P. To help you find the information you need wed like to know if you are an employee or an employer.

Overview of Connecticut Taxes Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn. 23 lignes Living Wage Calculation for Connecticut. 2020 Social Security Benefit Adjustment Worksheet.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. 40 times the minimum wage will be equal to 520 weekly in January 2022 increasing to 560. Counties and Metropolitan Statistical Areas in Connecticut.

A Hourly wage GP WPD B Daily wage GP C Weekly wage GP WDW D Monthly wage Annual wage 12 E Annual wage 52 C - In case the pay rate is weekly. The assumption is the sole provider is working full-time 2080 hours per year. 23 lignes Living Wage Calculation for Bridgeport-Stamford-Norwalk CT.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. For periods 1 to 4 you will need to calculate the amount of your 10 Temporary Wage Subsidy a separate program that applies to this CEWS claim period before you enter it at Line F. The latest budget information from April 2021 is used to show you exactly what you need to know.

A Hourly wage B WPD B Daily wage GP WDW. There are legal minimum wages set by the federal government and the state government of Connecticut. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Connecticut Minimum Wage is the lowermost hourly rate that any employee in Connecticut can expect by law. Show results for Connecticut as a whole. Why not find your dream salary too.

See how we can help. Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Connecticut paycheck calculator. If your wages are less than or equal to the Connecticut minimum wage multiplied by 40 your weekly benefit rate under the PFMLA will be 95 of your average weekly wage.

The results are broken up into three sections. The tool provides information for individuals and households with one or two working adults and zero to three children. 2020 Tax Tables to 102K.

This Connecticut hourly paycheck calculator is perfect for those who are paid on an hourly basis. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. 2020 Tax Tables to 500K.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Its the tool our Infoline advisers use to answer your enquiries. One of a suite of free online calculators provided by the team at iCalculator.

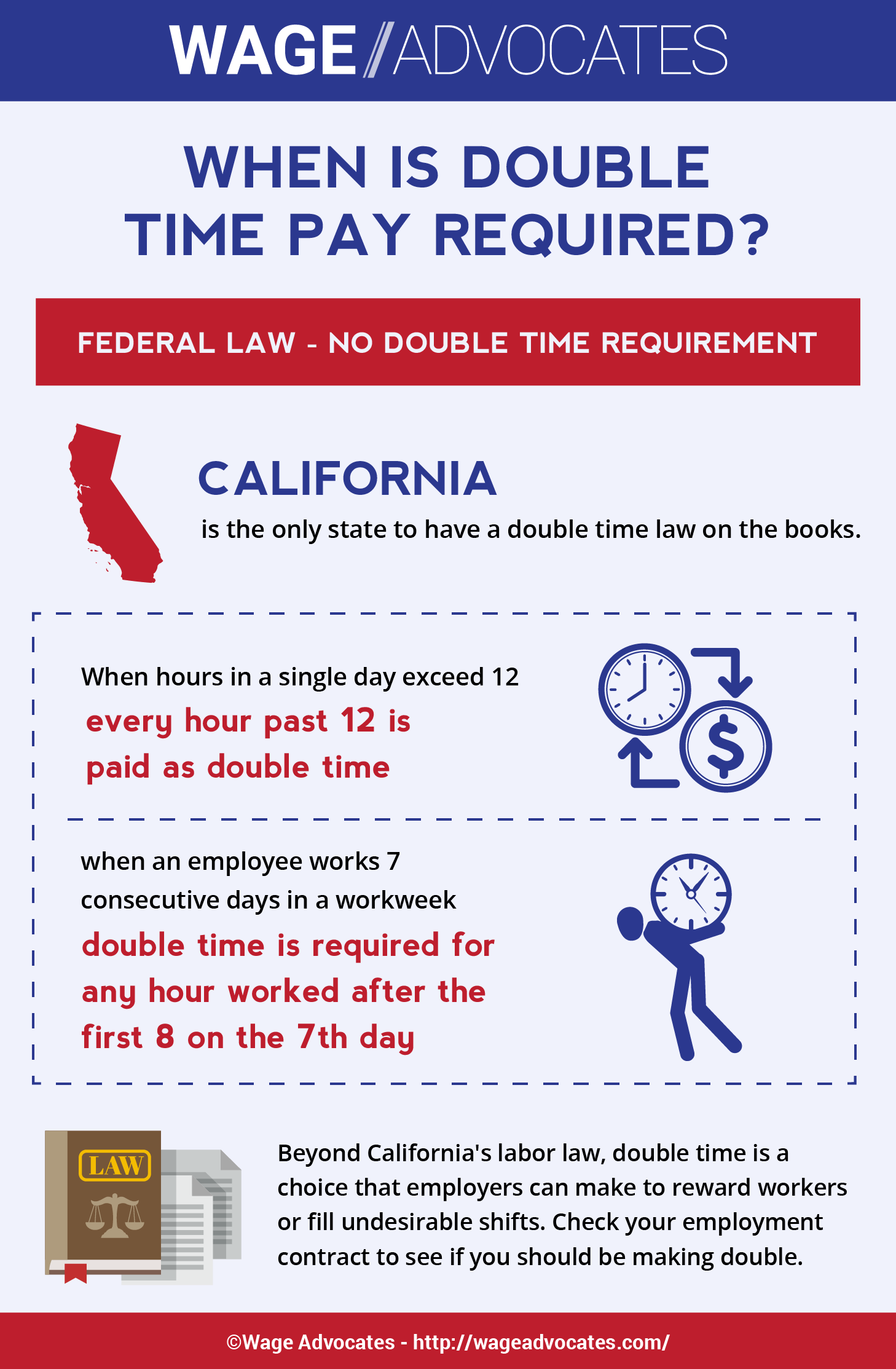

The prevailing wage rate schedules developed by the US. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. The Pay Calculator calculates base pay rates allowances and penalty rates including overtime.

How to Calculate Prevailing Wage Payments. Select a link below to display the living wage report for that location. The assumption is the sole provider is working full-time 2080 hours per year.

The term prevailing wage means the total base hourly rate of pay and bona fide fringe benefits customary or prevailing for the same work in the same trade or occupation in the town where the project is to be constructed. In the case of households with. C Weekly wage GP WPD WDW D Monthly wage E 12 E Annual wage 52 C - In case the pay rate is daily.

Department of Labor and used by the. Hourly rates weekly pay and bonuses are also catered for. The tool provides information for individuals and households with one or two working adults and zero to three children.

The Connecticut Salary Calculator allows you to quickly calculate your salary after tax including Connecticut State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Connecticut state tax tables. The tool provides information for individuals and households with one or two working adults and zero to three children. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 2020 Income Tax Calculator. 2020 Tax Calculation Schedule.

Prevailing Wage Components. The assumption is the sole provider is working full-time 2080 hours per year. For claim periods 5 and later the amount for this line will be 0.

How To Calculate Wages 14 Steps With Pictures Wikihow

Iba To Review Performance Linked Pay For Bank Employees Finance Being A Landlord Management Company

The Salary You Need To Be Paid In Every State To Afford A Home In 2021 30 Year Mortgage Buying Your First Home Poverty Rate

What Is A Living Wage Minimum Income For Basic Needs Above Poverty

What S The Difference Between Minimum Wage Prevailing Wage And Living Wage Govdocs

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

What S The Difference Between Minimum Wage Prevailing Wage And Living Wage Govdocs

How To Calculate Wages 14 Steps With Pictures Wikihow

Pin On Education And Financial Lit

Universal Living Wage Wage Calculator

For Employees Employee Resources Learn How Paid Leave Applies To You

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Wages 14 Steps With Pictures Wikihow

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Appstore For Android

Ultimate Guide To H1b Wage Levels Prevailing Wages 2021

Covid 19 Tax Update On The Temporary Wage Subsidy Scheme Mazars Ireland

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Connecticut Paycheck Calculator Smartasset

Post a Comment for "Wage Calculator Ct"