Gross Salary Unemployment

For Example A you would report working a total of 9 hours and gross wages of 7200 regardless of whether or not you have been paid for this work. In some states if your calculated weekly benefit surpasses.

Understanding The Contents Of A French Pay Slip Fredpayroll

146 of the Gross Wage as well as a additional contribution of approx.

Gross salary unemployment. The data collected is Tax Year Ending. Employee has to be in the same job for over 12 months. Multiply this amount by four percent to determine your weekly unemployment pay.

Specifically the gross salary reflected in the payroll is deducted from the IRPF and the items contributed by the workers in the form of contributions for common contingencies 47 unemployment in fixed contracts 15 unemployment in temporary contracts 16 and professional training 01. Gross average salary is calculated for full-time employees. Your total wages are 5500.

The UK average salary was 386k in 2020. The UK average salary was 386k in 2020. Gross wages also called gross pay are the amount an employee receives during a pay period before taxes and other payroll deductions.

In some states employers also are allowed to deduct the cost of uniforms and tools from employee pay as long as it does not cause the employees. Exeter average salary comparison The average salary is ranging between 274k in Teignbridge and 325k in Exeter. 24 of the Gross Wage will be paid by the employee and by the employer together half by half.

The data was published in November 2020. Gathering the Necessary Information. The data collected is Tax Year Ending.

De très nombreux exemples de phrases traduites contenant net gross salary Dictionnaire français-anglais et moteur de recherche de traductions françaises. Start with their gross pay their total salary or wages. Unemployment benefits are considered a gross wage and are taxable because they partially replace lost wages due to being laid off from a job.

Employee has to be in the same job for over 12 months. Using a calculator enter the amount you earned for the quarter with the highest gross income out of all four quarters. You should plan on covering a full year of pay stubs.

S gross salary for income tax and that the grievor had therefore been treated in accordance with the current approved CRA formula. The Board found that in absence of such permission the CF could not deduct a specific percentage of the griev or. Dorset average salary comparison The average salary is ranging between 345k in Dorset and 359k in Bournemouth Christchurch and Poole.

For Example B you would report working a total of 23 hours rounding down 2325 hours to 23 hours and gross wages of 20925 regardless of whether or not you have been paid for this work. The law requires your employer to withhold a portion of your pay to cover federal state and local income taxes as well as Social Security which claimed 62 percent of gross pay as of 2013. It does not include any allowances overtime or any extra compensation.

Employee has to be in the same job for over 12 months. If you received unemployment compensation during the year you should receive Form 1099-G which is a report of income received from a government source showing the amount you were paid. There are some deductions over which you have no control.

130 dependent to your insurance company The half will be paid by the employer and the other half by the employee for both parts of the Health Insurance. Gross average salary is calculated for full-time employees. Gross average salary is calculated for full-time employees.

Average net wages and. Basic salary is the amount paid to an employee before any extras are added or taken off. Add 12349 to the 12 that you get for both of your dependents.

In order to calculate gross wages for unemployment benefits you will first need to gather your pay stubs and take note of all deductions that have occurred. If your calculated pay is below your states minimum weekly benefit rate you will receive the minimum unemployment pay. Before you can get started youll need some basic information.

The UI tax funds unemployment compensation programs for eligible employees. The UK average salary was 386k in 2020. The data was published in November 2020.

First check your states unemployment website to find out how your gross pay is. Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health. Calculating how much is earned is very dependent on which state you are in so it can be helpful to use a weekly unemployment benefits calculator.

Any unemployment compensation received must be included in your income and should be reported in the appropriate sections of your federal and state tax returns. Gross Salary is the amount of salary after adding all benefits and allowances but before deducting any tax. The data collected is Tax Year Ending.

The average salary is ranging between 335k in East Hampshire and 453k in Hart. Employers covered under Wisconsins Unemployment Insurance law are required to report quarterly wage information for each employee. De très nombreux exemples de phrases traduites contenant gross unemployment Dictionnaire français-anglais et moteur de recherche de traductions françaises.

Social Protection Statistics Unemployment Benefits Statistics Explained

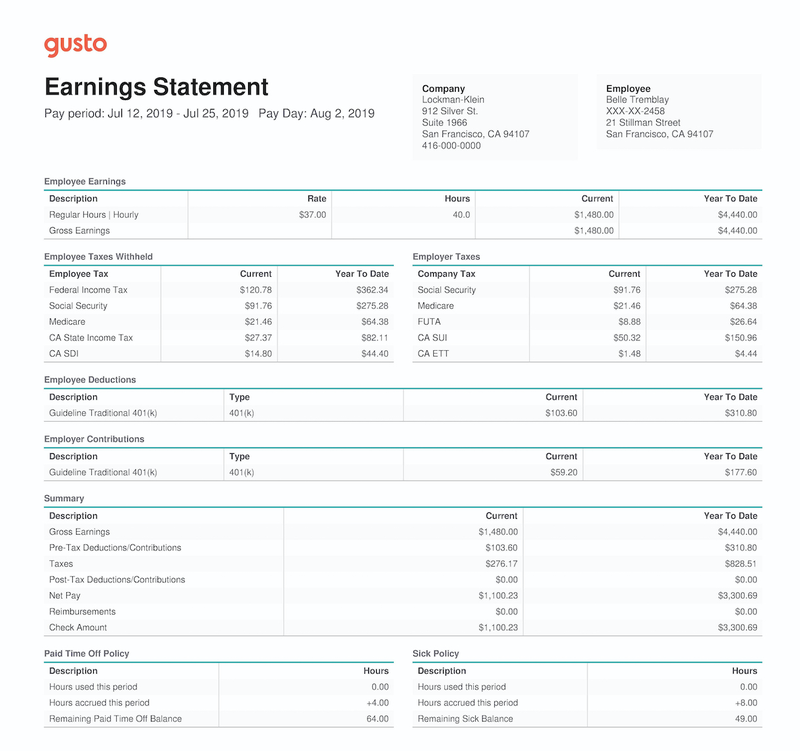

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding The Contents Of A French Pay Slip Fredpayroll

Gross Wages What Is It And How Do You Calculate It The Blueprint

Social Protection Statistics Unemployment Benefits Statistics Explained

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Unemployment Benefits Comparison By State Fileunemployment Org

Algeria Unemployment Rate 2020 Statista

How Unemployment Benefits Are Calculated By State Bench Accounting

Esdwagov Calculate Your Benefit

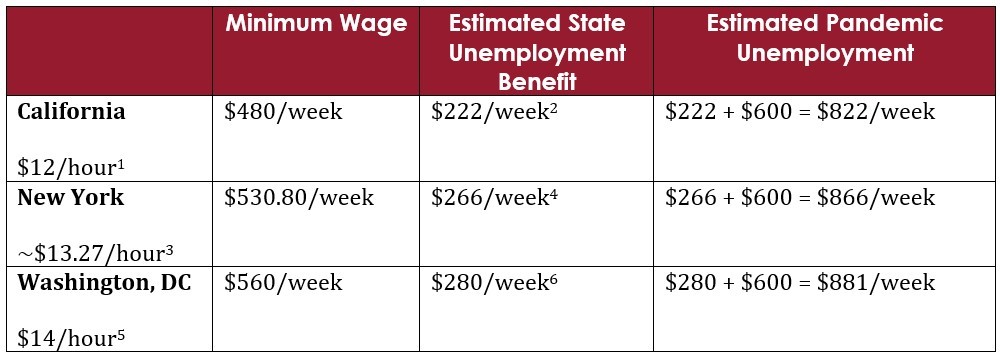

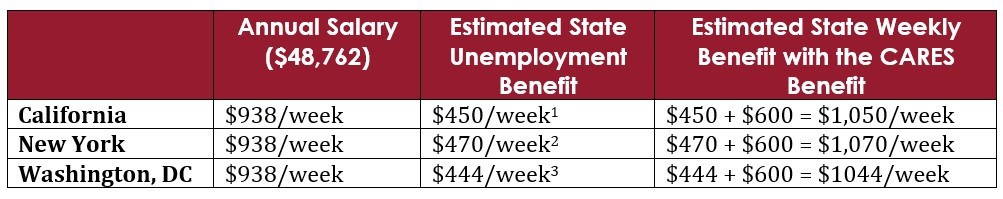

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Social Protection Statistics Unemployment Benefits Statistics Explained

Gross Net Salary The Urssaf Converter

Unemployment Counts As Income For Covered Ca Magi Subsidies

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

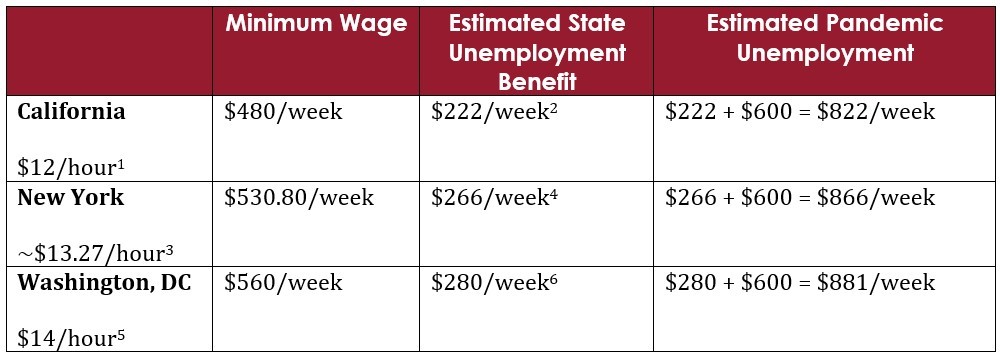

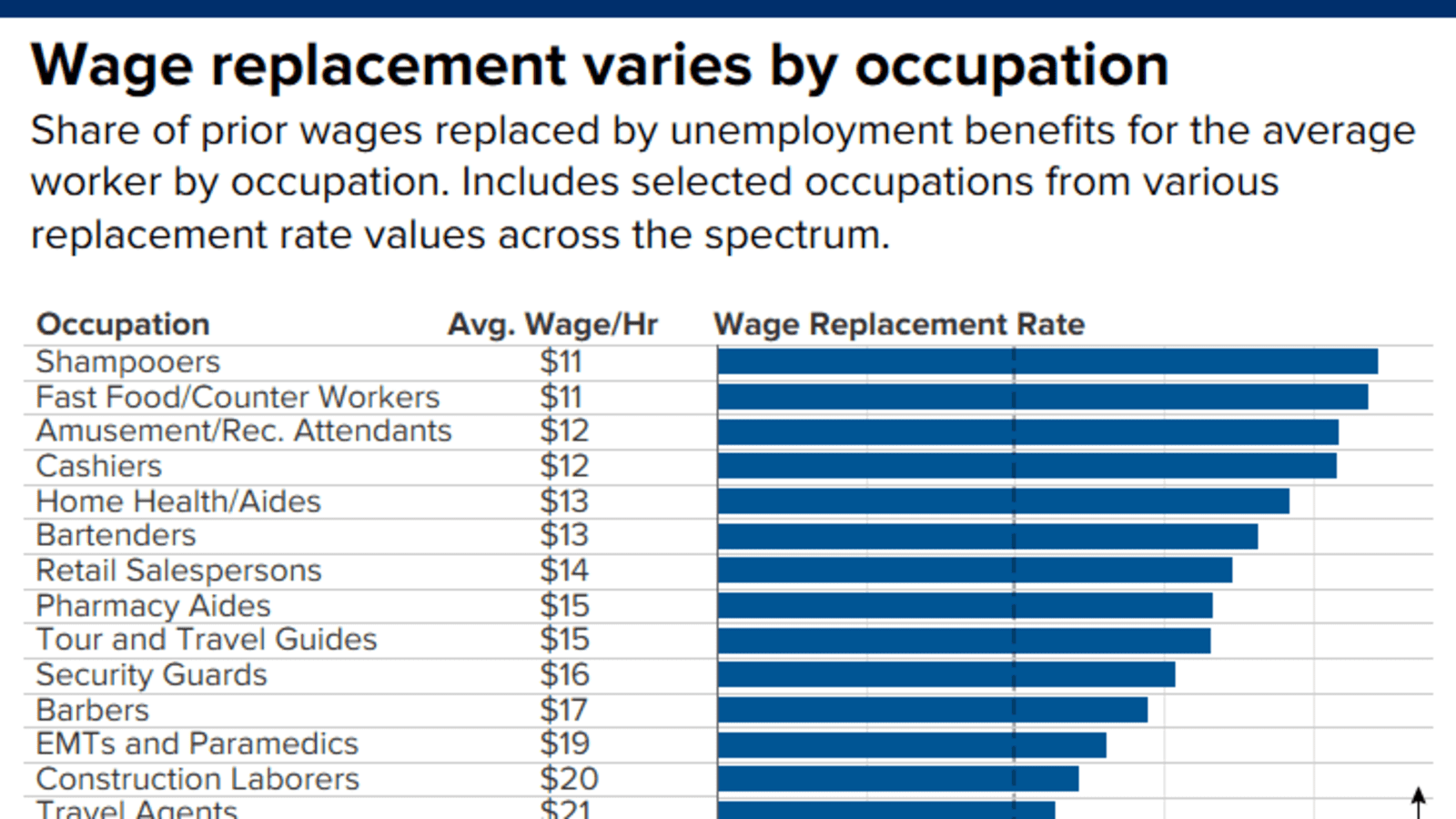

It Pays To Stay Unemployed That Might Be A Good Thing

Social Protection Statistics Unemployment Benefits Statistics Explained

Post a Comment for "Gross Salary Unemployment"