Salary Calculator Quebec

The calculator is updated with the tax rates of all Canadian provinces and territories. The payroll calculator from ADP is easy-to-use and FREE.

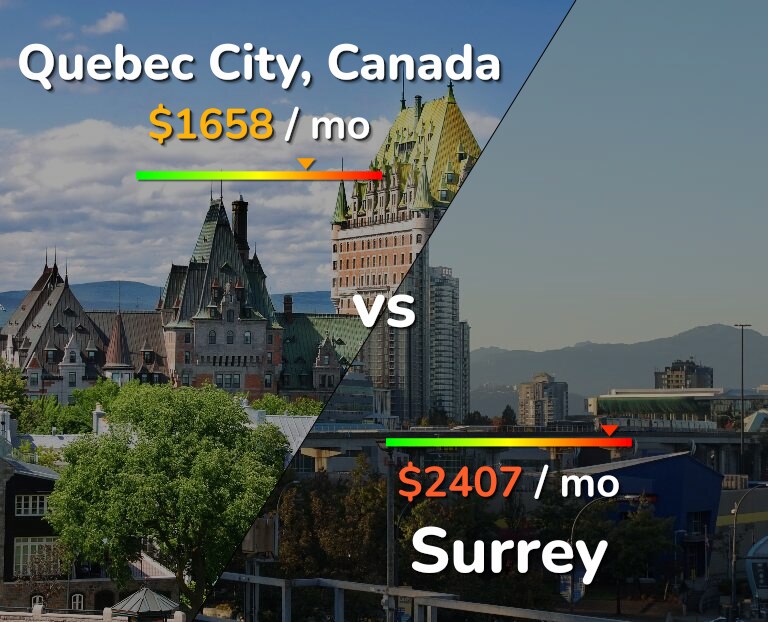

Quebec 1160 Vs Surrey 1649 Cost Of Living Salary Comparison

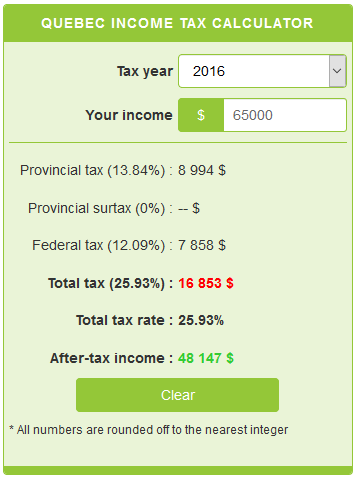

Quebec provincial income tax rates 2020 In 2020 Quebec provincial income tax brackets and provincial base amount was increased by 19.

Salary calculator quebec. To start complete the easy-to-follow form below. In Quebec sales taxes are charged differently on used motor vehicle sales depending on who sells it to you. Basic personal amount in Quebec for year 2020 is 15532.

Source deductions of Québec income tax contributions to the Québec Pension Plan and Québec parental insurance plan premiums. Salary Before Tax your total earnings before any taxes have been deducted. If you buy a used car from another person however you will only need to pay QST on the greater of the sales price or the estimated value of the vehicle.

Calculate the salary that you will need in Quebec City based on the cost of living difference with your current city. You will get a 14-page downloadable report calculating the salary youll need. If you buy a used car from a dealer you will have to pay both the 5 GST and 9975 QST on the agreed sales price.

Enter your pay rate. Employer contributions to the Québec Pension Plan and the health services fund as well as employer Québec parental insurance plan premiums. Enter the number of hours worked a week.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. That means that your net pay will be 40512 per year or 3376 per month. An entry level calculator 1-3 years of experience earns an average salary of 31751.

It is perfect for small business especially those new to doing payroll. The indexation factor for 2021 is 126 or 10126. The Quebec Income Tax Salary Calculator is updated 202122 tax year.

Also known as Gross Income. Use our Income tax calculator to quickly estimate. Quebec Income Tax Calculator.

For example the basic personal. The Quebec Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Quebec salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Quebec Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to. As of Jun 30 2021 the average annual pay for the Hourly jobs category in Quebec is 34033 an year.

PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. For only 50 USD you will know the salary you need in Quebec City to maintain your current standard of living after you move. You can use WinRAS to calculate the following.

This means that tax brackets and tax credits will increase by 126. Quebec income tax rates are staying the same for both 2020 and 2021 but the levels of each tax bracket will be increasing. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

Youll then get a breakdown of your total tax liability and take-home pay. Quebecs personal income tax system is indexed against the Quebec consumer price index CPI. Just in case you need a simple salary calculator that works out to be approximately 1636 an hour.

On the other end a senior level calculator 8 years of experience earns an average salary of 50071. Accurate reliable salary and compensation comparisons for Québec Canada. Income tax calculator takes into account the refundable federal tax abatement for Québec residents and all federal tax rates are reduced by 165.

Salary estimates based on salary survey data collected directly from employers and anonymous employees in Montréal Québec. It would be ideal if you note that 2020 is the default tax year utilized in the Quebec personal income tax calculator you can choose an alternate tax year in the advanced feature of the calculator. Your average tax rate is 221 and your marginal tax rate is 349.

This is the equivalent of 654week or 2836month. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. Québec Canada - Get a free salary comparison based on job title skills experience and education.

You do not pay the QST amount to. Salary calculations include annual income charge deductible components for example Child Care Alimony and incorporate family related tax stipends. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

7 lignes Income Tax Calculator Quebec 2020. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. The amount can be hourly daily weekly monthly or even annual earnings.

This is required information only if you selected the hourly salary option.

Confluence Mobile Community Wiki

Confluence Mobile Community Wiki

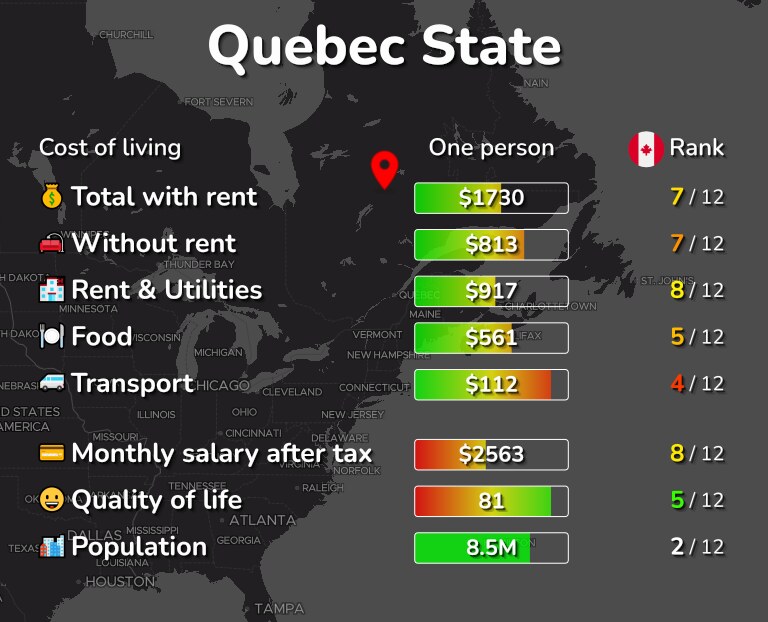

Cost Of Living In Quebec State 1290 Average 60 Cities Ranked

A Complete Guide To Hire Employees In Quebec Nnroad

Confluence Mobile Community Wiki

2021 Quebec Province Tax Calculator Canada

Quebec Income Tax Calculator Calculatorscanada Ca

Confluence Mobile Community Wiki

Velocity Banking Spreadsheet Template Interest Calculator Credit Card Interest Credit Card Payment

Canada Global Payroll And Tax Information Guide Payslip

Confluence Mobile Community Wiki

Average Salary In Quebec 2021 The Complete Guide

How To Convert Ielts To Clb Ielts Online Converter Ielts General Training

Quebec Income Calculator 2020 2021

Tax Corporate Income Tax Rates Bdo Canada

A Complete Guide To Hire Employees In Quebec Nnroad

Confluence Mobile Community Wiki

Post a Comment for "Salary Calculator Quebec"