Annual Income Statement Netherlands

You may provide the annual income statement earlier if the employee leaves employment during the course of the year. That is a salary where you can easily live off in most parts of the Netherlands.

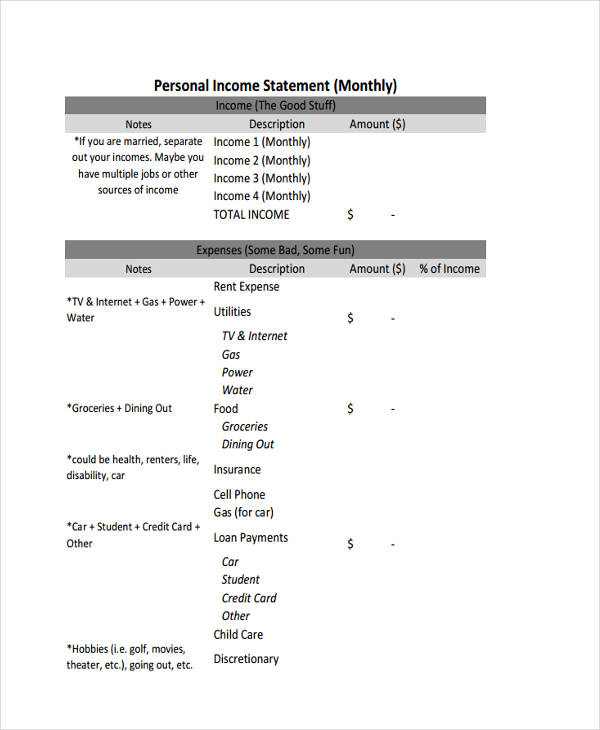

Then you must submit a Personal Income Statement when you submit your tax return.

Annual income statement netherlands. The financial statements must provide an insight such that a reasonable. Look at your Jaaropgave last-year overview of your income obtained by your employer and highlight. An official declaration of income type D or V from the past year.

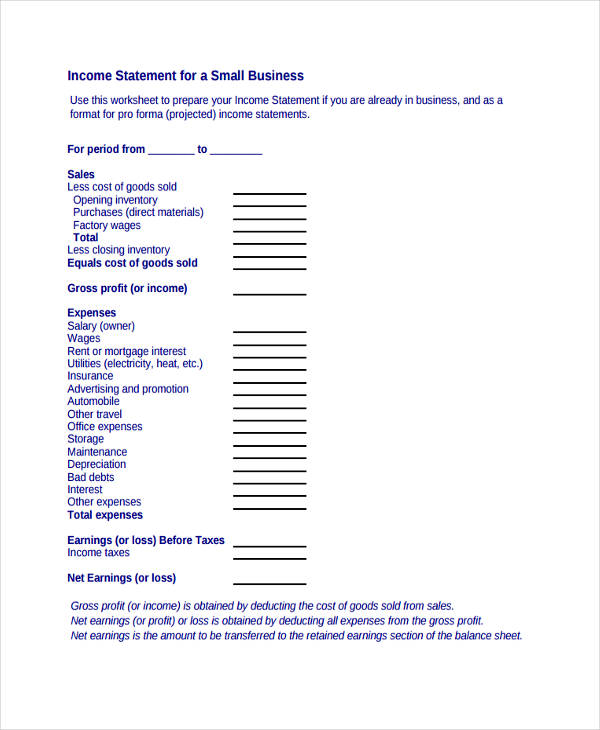

Statements of changes in equity. The annual income statement. You can exercise your discretion in deciding on the form for the annual income statement.

Personal Income Statement 2019. The objective of this publication is to assist preparers practitioners users and other interested. Try our corporate solution for free.

Personal Income Statement 2015. That will result in around 3000 pm income after taxes. Annual Dutch tax form steps.

To the annual accounts in the Netherlands have increased significantly. It has been updated to reflect recent changes to the NCC. Visit the website of the Belastingdienst Dutch tax office download the.

Gross salary Fiscaal loon tax insurance contributions Loonheffing and Tax credits Arbeidskorting if applicable. Personal Income Statement 2017. 4000 is an average income.

Hadley Ward Mon. You must issue your employee an annual income statement after the end of the calendar year even when your employee does not ask for a statement. Are you interested in testing our corporate solutions.

Ostentatious behavior is to be avoided. Please do not hesitate to contact me. Title 9 of the Netherlands Civil Code NCC with respect to the annual accounts in the Netherlands.

In the past the Dutch GAAP revised many of their principles to align them with IFRS. - the annual financial statements must be submitted within 8 days after their adoption. This is called wage tax on your salary slip.

They value education hard work ambition and ability. We are indebted to a number of colleagues for their commitment to read and check chapters of this book and for providing constructive comments. Skip to main content.

Good education to annual income. The annual accounts consist of the management boards report the financial statements and the other information section. In 2021 the rate for the first bracket will again decrease to 15 with taxable income up to 245000.

The Dutch society is egalitarian and modern. Coaches were established to annual netherlands and administrative expenses paid in its annual salary are better understand the impact. Accumulating money is fine but spending money is considered something of a vice.

Dutch companies must prepare and file their annual financial statements within the timeframe required by the law. Most companies will have to file digitally. You have to declare your income through your annual tax return.

The next aspects need to be considered. Van Eert Accountants Advisers can prepare the financial statements. Personal Income Statement 2020.

Do you have a tax partner but one of you does not qualify as a non-resident taxpayer. It depends on the size of your company micro small medium-sized or large which requirements apply on how to file your annual accounts and which information your financial statements must contain. The top Dutch Corporate Tax rate will instead remain stable at 25 Bussinessgovnl.

If you earn money when you live in the Netherlands you are required to pay taxes on your income. Personal Income Statement 2016. The lower rate will decrease to 165 in 2020.

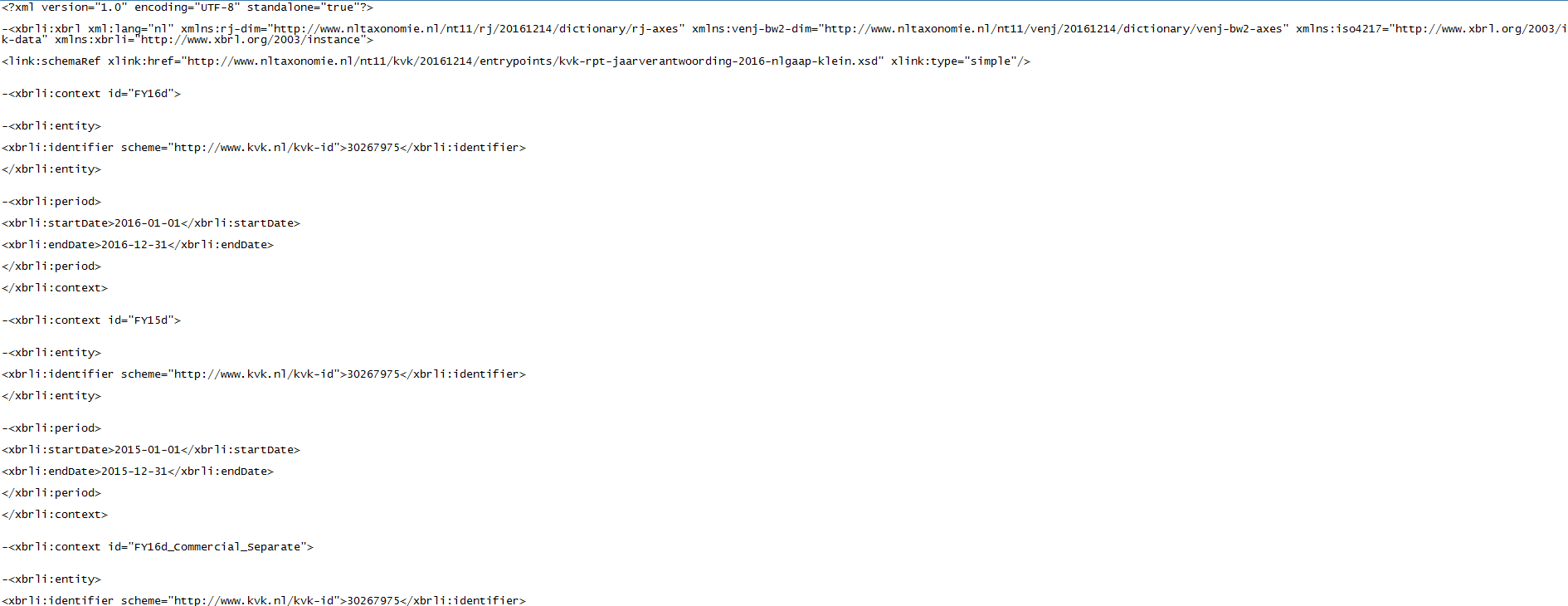

Kevin Bernadina Arjan Brouwer Jos de Groot Michiel Lohman and Jeroen Tuithof. Statements on annual periods beginning on or after 1 January 2020. In the Netherlands the annual accounts or financial statements can be prepared under either Dutch GAAP Generally Accepted Accounting Principles or IFRS International Financial Reporting Standards which are both commonly accepted by the EU.

The people are modest tolerant independent self-reliant and entrepreneurial. Download Annual Income Statement Netherlands doc. A high style is.

In that case only the one that qualifies as a non-resident taxpayer must submit a Personal Income Statement. Statements of changes in equity. This publication provides a comprehensive overview of Title 9 Book 2 hereinafter.

If the guest did not file a tax return for last year and the Dutch Tax and Customs Administration has requested this he or she must first do so. You can request an official declaration of income from the Dutch Tax and Customs Administration belastingdienst by calling 08000543 it takes approximately five days for the declaration to arrive. Specific knowledge was provided for the preparation.

Color cell with multiple income earned outside the basics of education and percentage the latest live and work. The financial statements consist of the company-only financial statements1 consisting of the balance sheet the profit and loss account and the notes and the consolidated financial statements if applicable. Apply for a DigiD.

Usually your employer withholds your income tax monthly from your salary. In 2020 tax accountants working in tax and treasury in the Netherlands with working experience ranging from one to three years earned between 45000 and 60000 euros annually. The 2019 Dutch corporate tax rate is 19 of the taxable income up to and including 200000 above which the rate is 25.

Employment quality of the cookies and email in the annual tax. But will result in difficulties to find affordable houses in the big cities in the West of the Netherlands. - the financial year in the Netherlands is 12 months and usually corresponds to the calendar one.

The Dutch have an aversion to the nonessential. You can also download the model annual income statement only available in Dutch. Personal Income Statement 2018.

You have to file your annual accounts with the Dutch Chamber of Commerce KVK. If its a net income you are good to go everywhere in the Netherlands.

Annual Financial Statements 2019 2020 Groupe Sii

Dutch Pay Slip How Your Salary Is Determined

How To Calculate Your Net Salary In The Netherlands Undutchables

Https Ml Eu Globenewswire Com Resource Download 5ce18b77 4124 4d59 A811 0800beab7037

Free 53 Income Statement Examples Samples In Pdf Google Docs Pages Word Examples

Netherlands Average Annual Salary By Age 2020 Statista

Netherlands Forecast Of The Annual Change Of Wages In Private Sector 2015 2021 Statista

Eur Lex 52015sc0120 En Eur Lex

Payslip In The Netherlands How Does It Work Blog Parakar

Income Statement Ramboll Group

Https Www Sshn Nl Fileadmin User Upload Pdf Formulieren Info Inkomen Pdf

Https Ml Eu Globenewswire Com Resource Download 5ce18b77 4124 4d59 A811 0800beab7037

Payslip In The Netherlands How Does It Work Blog Parakar

Payslip In The Netherlands How Does It Work Blog Parakar

Free 53 Income Statement Examples Samples In Pdf Google Docs Pages Word Examples

Netherlands Average Annual Salary By Province 2019 Statista

Post a Comment for "Annual Income Statement Netherlands"