Wage Calculator Oklahoma

The living wage shown is the hourly rate that an. Free Oklahoma Salary Paycheck Calculator.

If You Re In The Process Of Buying A Home These Tips Will Help You Along The Way Dre 02066701 Home Buying Florida Real Estate Real Estate Information

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Oklahoma.

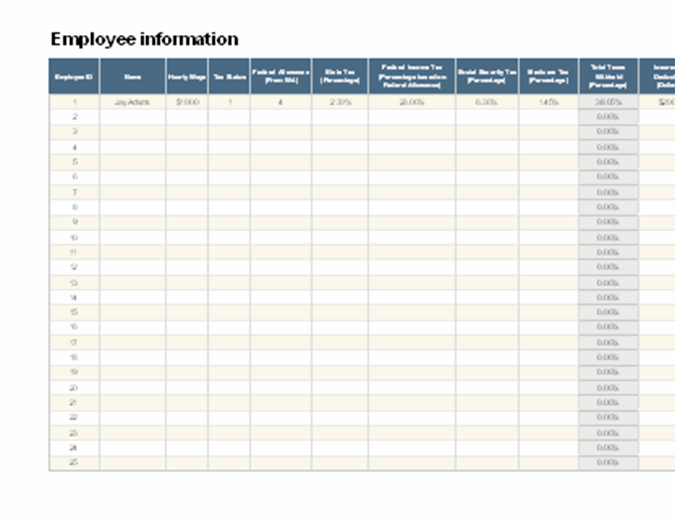

Wage calculator oklahoma. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On. Enter your info to see your take home pay. In order to determine an.

How much do you make after taxes in Oklahoma. Your household income location filing status and number of personal exemptions. The tool provides information for individuals and households with one or two working adults and zero to three children.

In the case of households. The tool provides information for individuals and households with one or two working adults and zero to three children. In the case of households with.

This Oklahoma hourly paycheck calculator is perfect for those who are paid on. The federal minimum wage is 725 per hour and the Oklahoma state minimum wage is 725 per hour. There are legal minimum wages set by the federal government and the state government of Oklahoma.

The Oklahoma Minimum Wage is the lowermost hourly rate that any employee in Oklahoma can expect by law. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator. 23 lignes Living Wage Calculation for Oklahoma City OK.

For a married couple with a combined income of 100000 their take home pay will be 79763. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Use our calculator to discover the Oklahoma Minimum Wage. 23 lignes Living Wage Calculation for Oklahoma. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma. Our income tax calculator calculates your federal state and local taxes based on several key inputs. A single filer who makes 50000 annual wage will take home 3989250 after taxes.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The law states that. The results are broken up into three sections.

Fast accurate to the cent and incredibly easy to use this software serves one purpose and one purpose alone. Oklahoma Salary Paycheck Calculator. SmartAssets Oklahoma paycheck calculator shows your hourly and salary income after federal state and local taxes.

In the case of households with. This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. First calculate gross wages.

If there is no state minimum wage or a wage that is lower than 725 then the employees in that state are entitled to 725 per hour. The assumption is the sole provider is working full-time 2080 hours per year. 2021 Minimum Wage Calculator Hourly Wage Rate.

Our free Oklahoma salary paycheck calculator is a tool that no growing company should be without. Welcome to the Oklahoma Wage Calculator. For salaried employees take their annual salary and divide it by the number of pay periods.

To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The only state-level tax Oklahoman need to pay is the income tax which ranges from 05 to 5. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

The Oklahoma Salary Calculator allows you to quickly calculate your salary after tax including Oklahoma State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Oklahoma state tax tables. Living Wage Calculation for Cleveland County Oklahoma. Using our Oklahoma Salary Tax Calculator.

They all go into gross wages. If your employee is being paid hourly simply multiply the number of hours worked during the pay period by the hourly rate. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

The tool helps individuals communities and employers determine a local wage rate that allows residents to. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The assumption is the sole provider is working full-time 2080 hours per year. Total Estimated Tax Burden 14688. One of a suite of free online calculators provided by the team at iCalculator.

See how we can help improve your. Created with Highcharts 607. WHAT IS THE LIVING WAGE CALCULATOR.

The assumption is the sole provider is working full-time 2080 hours per year. Percent of income to taxes 26. Oklahoma Hourly Paycheck Calculator Results Below are your Oklahoma salary paycheck results.

The tool provides information for individuals and households with one or two working adults and zero to three children. Living Wage Calculation for Tulsa County Oklahoma. Dont forget about bonuses commissions and tips.

To help get your people get paid accurately and on time with the least possible effort on your end. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Oklahoma Hourly Paycheck Calculator.

Electronic Communication Network Or Ecn Links Small Market Participants With Tier 1 Liquidity Provider Through A Forex Ecn Broker Forex Brokers Brokers Forex

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Appstore For Android

Cost Of Living Calculator How Does Oregon Compare With The Rest Of The Country Cost Of Living Oregon Future Plans

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Oklahoma Paycheck Calculator Smartasset

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

Gosi Benefits For Saudi Expat Workers In Saudi Arabia Saudi Jawazat Saudi Vision 2030 Saudi Iqama Saudi Visa Umrah Vi Brochure Life Home Decor Decals

Day 39 Saying You Don T Need A Librarian Because You Have The Internet Is Like Saying You Don T Need A Math Teacher Funny Reading Quotes Reading Quotes Words

Amortization Schedule Example Mortgage Amortisation Schedule Calculator Read This Before You Re Amortization Schedule Excel Tutorials Mortgage Amortization

Tom Cole Very Concerned About Oklaed Funding Nondoc Tom Cole Toms Other People

Finchannel Com Home Prices Outpacing Wage Growth In 76 Of Us House Prices Price Wage

Payment Schedule Template Excel Awesome Amortization Schedule Template 5 Free Word Excel Amortization Schedule Schedule Template Payment Schedule

Home Nextadvisor With Time Minimum Wage Rent Wage

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Appstore For Android

Post a Comment for "Wage Calculator Oklahoma"