Wage Calculator Uk Pro Rata

19240 pounds a year is how much every two weeks. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

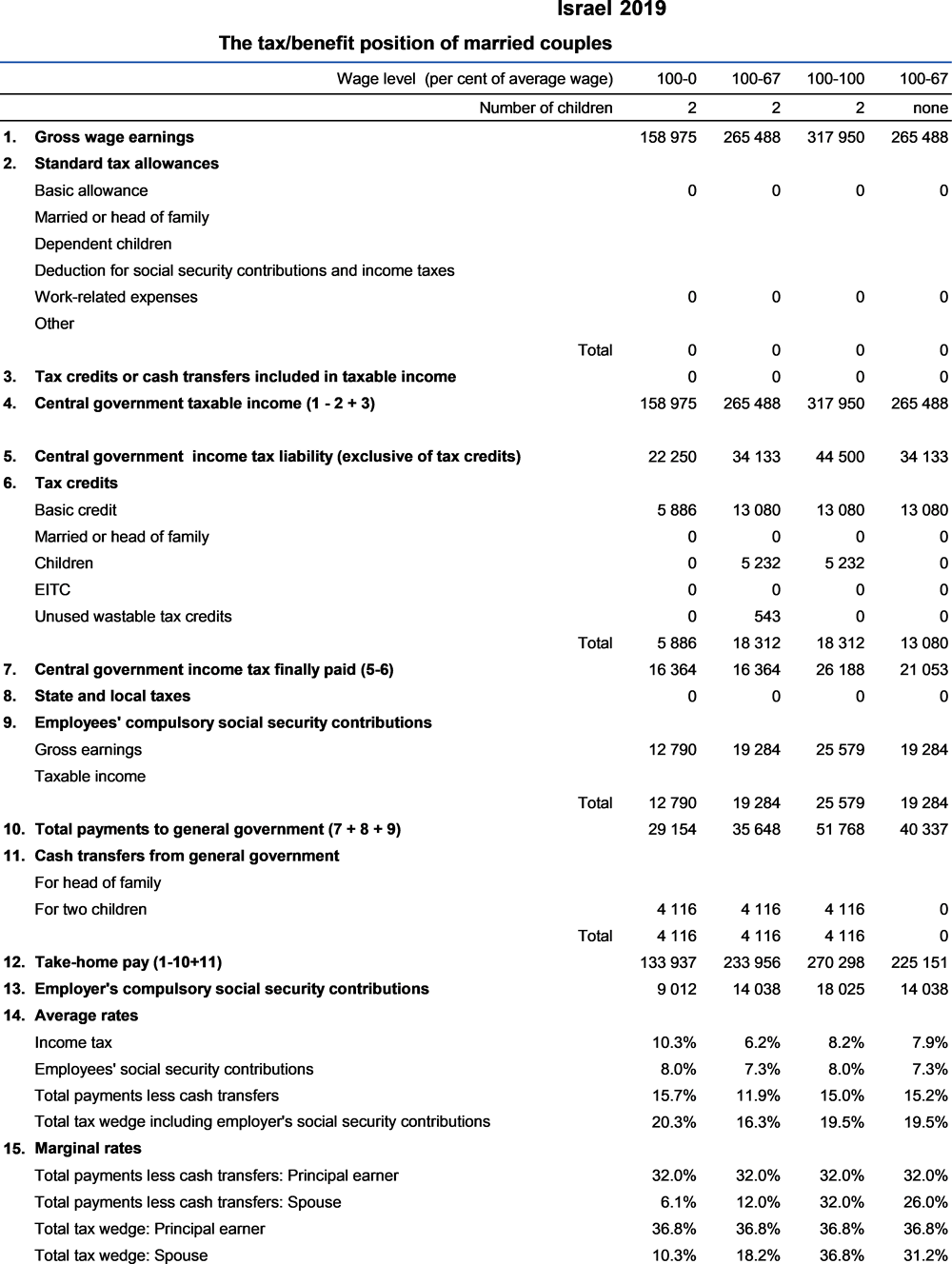

International Aspects Of The Taxation Of Corporations And Shareholders In Imf Staff Papers Volume 1975 Issue 002 1975

To help illustrate this and figure out exactly how much you get to take home from your pro-rata salary we have produced this simple pro-rata tax calculator to do all the annoying number crunching for you.

Wage calculator uk pro rata. We offer you the chance to provide a gross or net salary for your calculations. 10 pounds an hour is how much a year. First divide 30000 52 to get the weekly salary which is 5769.

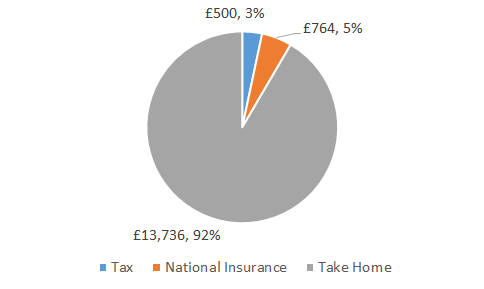

To keep the calculations simple overtime rates are based on a normal week of 375 hours. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Please see the table below for a more detailed break-down.

The simplest way to work out how much youd be paid on a pro rata basis is dividing the annual salary by the number of full time hours and then times this number by the pro rata hours. Our salary calculator will provide you with an illustration of the costs associated with each employee. Enter the number of hours and the rate at which you will get.

When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator. For example you may be paid an annual salary of 25000 pro rata - but you only actually work for part time in which case youll be paid a proportion of the 25000 based on how much of the expected time youre actually working. 750 x 25 pro rata.

In other words its more helpful to think about it as a wage rather than a salary. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Your salary will be calculated according to what proportion of a full-time job your hours make up.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save. For example for 5 hours a month at time and a half enter 5 15. Enter the number of hours and the rate at which you will get paid.

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Welcome to the Salary Calculator - UK New. If your salary is 45000 a year youll take home 2853 every month.

UK Pro Rata Salary Calculator - How Part-Time Hours Impact Salary and Benefits. If an employee would receive 25000 for a 40-hour week then you can easily work out the hourly rate which is 25000 40 625. The better way to calculate pro rata pay entitlement is to work it out by hours rather than days.

If you are working out the new salary by number of hours worked enter the pro-rata number of weekly hours into the Pro-rata weekly hours box. How to use the Pro-Rata Salary Calculator To use the pro-rata salary calculator enter the full-time annual salary in the Full-time Salary box. How Do You Calculate Pro Rata Wages.

We strongly recommend you agree to a gross salary. Youll be able to see the gross salary taxable amount tax national insurance and. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021.

Updated for April 2021. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. 17610 x 2275 3875 10338 per annum pro rata This is indeed the wage they pay me But your calculator says my wage should be 1061265.

Your gross hourly rate will be 2163 if youre working 40 hours per week. We need to calculate the pro rata salary of a part-time employee who works 25 hours a week. If you want to see a percentage of your current salary enter that percentage into the of full-time salary.

Enter the number of weekly hours that are considered full-time into the Full-time weekly hours box and the new pro-rata number of weekly hours into the Pro-rata weekly hours box. For example if the salary is quoted at 18000 pro rata based on a full time week of 40 hours and you are working 30 hours per week you will be paid an annual salary of 13500. Find out the benefit of that overtime.

There are two options in case you have two different overtime rates. How to work out pro rata wage. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

So for the example above this would look as follows. Use the pro rata calculator above to find out how it. The proportion is based on the number of hours you work.

You can now choose the tax year that you wish to calculate. Once youve figured out the hourly rate. How to use the Take-Home Calculator.

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. You will see the costs to you as an employer including tax NI and pension contributions.

The results are broken down into yearly monthly weekly daily and hourly wages. 19240 pounds is about 740 pounds every two weeks biweekly. It includes things like pensions auto-enrolment student loans as well as the usual.

To use the pro-rata salary calculator enter the full-time annual salary in the Full-time Salary box and the number of weekly hours that are considered full-time into the Full-time weekly hours box. By default the 2021 22 tax year is applied but if you wish to see salary calculations for other years choose from the drop-down. The results are broken down into yearly monthly weekly daily and hourly wages.

Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. Next divide 5769 40 to get the hourly rate which is 144.

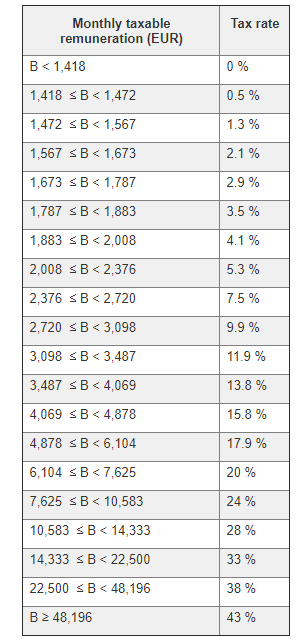

How Do You Calculate Pay As You Earn In Zambia

How Do You Calculate Pay As You Earn In Zambia

International Aspects Of The Taxation Of Corporations And Shareholders In Imf Staff Papers Volume 1975 Issue 002 1975

Http Www Ifs Org Uk Mirrleesreview Reports Wealth Transfers Pdf

International Aspects Of The Taxation Of Corporations And Shareholders In Imf Staff Papers Volume 1975 Issue 002 1975

49 000 After Tax 2021 Income Tax Uk

How Do You Calculate Pay As You Earn In Zambia

Daily Rate Income Tax Calculator 2021 Salary Calculator

How Do You Calculate Pay As You Earn In Zambia

How Do You Calculate Pay As You Earn In Zambia

Web 3 0 Natural Language Processing Flexible Working Salary Calculator

How Do You Calculate Pay As You Earn In Zambia

Hourly Salary Calculator Salary Calculator Hourly Rate

How Do You Calculate Pay As You Earn In Zambia

How Do You Calculate Pay As You Earn In Zambia

How Do You Calculate Pay As You Earn In Zambia

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Post a Comment for "Wage Calculator Uk Pro Rata"