Wage Calculator Ontario

You can use the Ontario Hourly Salary Calculator to compare upto 5 Hourly Salaries against your current Hourly Salary in Ontario or compare salary after tax Federal and Province tax in Ontario to other provinces in Canada. Yearly salary hourly wage hours per week weeks per year For guidance a standard working week for a full-time employee is around 40 hours.

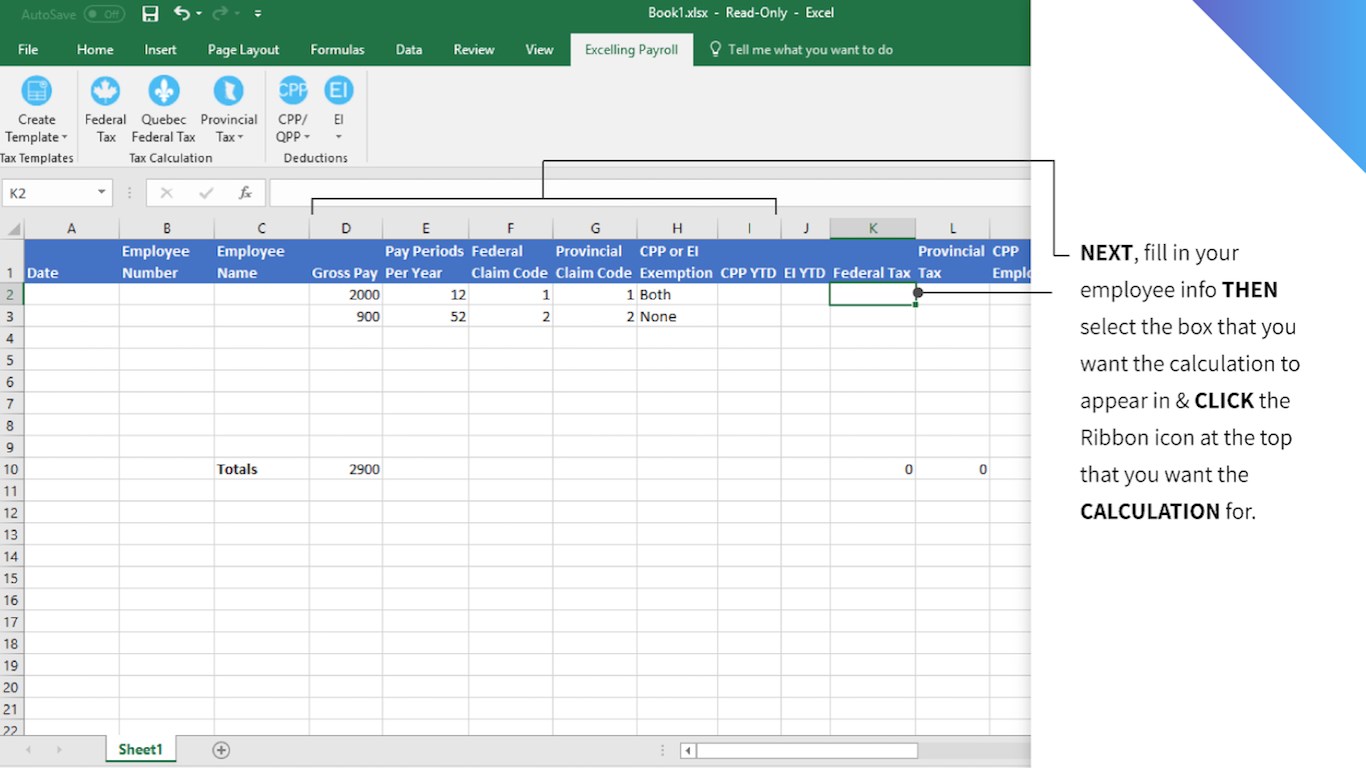

Payroll Calculator Free Employee Payroll Template For Excel

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Wage calculator ontario. Net annual salary Weeks of work year Net weekly income. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Youll then get a breakdown of your total tax liability and take-home pay.

Now you can go back to the Dues or Strike Calculator you were working on and enter the appropriate calculated amount into the Pay box on the left side. To limit the risks you take when using PDOC we recommend that you do the following. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

Ontarios indexing factor for 2021 is 09. Use this worksheet to calculate the amount of severance pay your employer may owe you. The calculator is updated with the tax rates of all Canadian provinces and territories.

Calculate your amount. Your 2020 Ontario income tax refund could be even bigger this year. To calculate provincial payroll deductions for Quebec use the WebRAS and WinRAS program from Revenu Quebec.

The Ontario Income Tax Salary Calculator is updated 202122 tax year. The amount can be hourly daily weekly monthly or even annual earnings. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income.

Formula for calculating net salary. For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour. Use the online calculator or downloadable spreadsheet before you apply to find the amount of CEWS or CRHP you can claim.

Net annual salary Weeks of work year Net weekly income. That means that your net pay will be 40568 per year or 3381 per month. What you need to know.

Enter your personal income to see how much provincial and federal income taxes you need to pay in Ontario. Ontario income tax calculator 2020. Were employed by an employer who.

Also known as Gross Income. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. If you make less than 10880 then you are exempt from Ontarios.

The second tax bracket at 915 is increasing to an upper range of 90287 from the previous 89482. For 2021 the basic personal amount is increasing to 10880. Enter your annual income taxes paid RRSP contribution into our calculator to estimate your return.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Calculate to see whether the CEWS or CRHP amount is higher so you will know which subsidy to apply for. This is required information only if you selected the hourly salary option.

The Ontario salary comparison calculator is designed to be used online with mobile desktop and tablet devices. Formula for calculating net salary. Enter your revenue and employee pay information into the calculator.

Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. Semi-Monthly Paid Employees Only paid 2 times per month - 24 pay days per year. The category of fishing and hunting guides is not considered in this calculator as it is very specific.

Enter the number of hours worked a week. The Ontario Basic Personal Amount was 10783 in 2020. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary.

Clear your Internet browser cache and close the browser after you complete your calculations. Salary Before Tax your total earnings before any taxes have been deducted. Minimum wage calculator Ontario 2019 Minimum wage rates list in Ontario for 2019 For 2018 until the end of 2019 the province of Ontario as decided to make an increase in the minimum wage of 240 over 2017 from 1160 to 14 per hour.

Have five or more years of employment with the employer and. Easy income tax calculator for an accurate Ontario tax return estimate. Enter your pay rate.

The category of fishing and hunting guides is not considered in this calculator as it is very specific. Your average tax rate is 220 and your marginal tax rate is 353. Although we do not keep any of the information you enter the.

Take one of the two calculated amounts from the boxes on the right. Has a payroll in Ontario of at least 25 million or. Gross annual income Taxes Surtax CPP EI Net annual salary.

To determine your annual salary take your hourly wage and multiply it by the number of paid hours you work per week and then by the number of paid weeks you work per year. This is called the indexing factor. If you are covered by the ESA you qualify for severance pay when your employment is severed and you.

The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142. Once you finish entering employee information the payroll deductions calculator generates a salary calculation result that shows the gross wages federal and provincial deductions CPP and EI contributions and the employees actual net pay.

Income Tax Formula Excel University

Ontario Payroll Tax Calculator 2020

Ontario Payroll Tax Calculator 2020

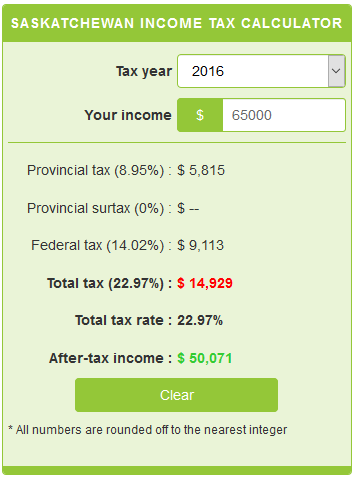

Saskatchewan Income Tax Calculator Calculatorscanada Ca

The Minimum Wage In Ontario In 2021 Dutton Employment Law

Tips For Parents Earning A Minimum Wage Salary Going Back To School Canadian Budget Binder

Toronto After Tax Income Calculator

How Do I Calculate Marginal Tax Rate

Download Canadian Payslip Paystub Maker For Free Good For Employers And Employees Canada Payroll Checks Maker

Welcome Payroll Law In Canada Ontario Specific Ppt Download

Financial Services Platform How To Calculate Income Tax Refund

Salary To Hourly Conversion Calculator

Ontario Payroll Tax Calculator 2020

Toronto After Tax Income Calculator

Are Wages Or Salary Fully Covered By Workers Compensation Insurance Workers Comp Perspectives

2021 Salary Calculator Robert Half

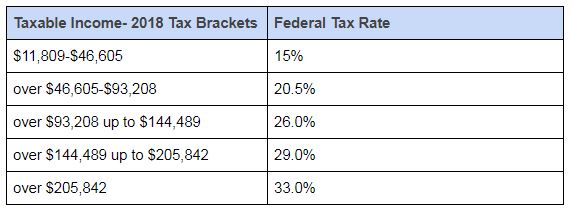

Canada S Federal Personal Income Tax Brackets And Tax Rates 2021 Turbotax Canada Tips

Mathematics For Work And Everyday Life

Post a Comment for "Wage Calculator Ontario"