Salary Calculator After Tax Uk

Salary after Tax Calculator Salary after Tax is an easy-to-use online calculator for computing your monthly or yearly net salary based on the local fiscal regulations for 2021. Salary Before Tax your total earnings before any taxes have been deducted.

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Federal Income Tax

Uniform tax rebate Up to 2000yr free per child to help with childcare costs.

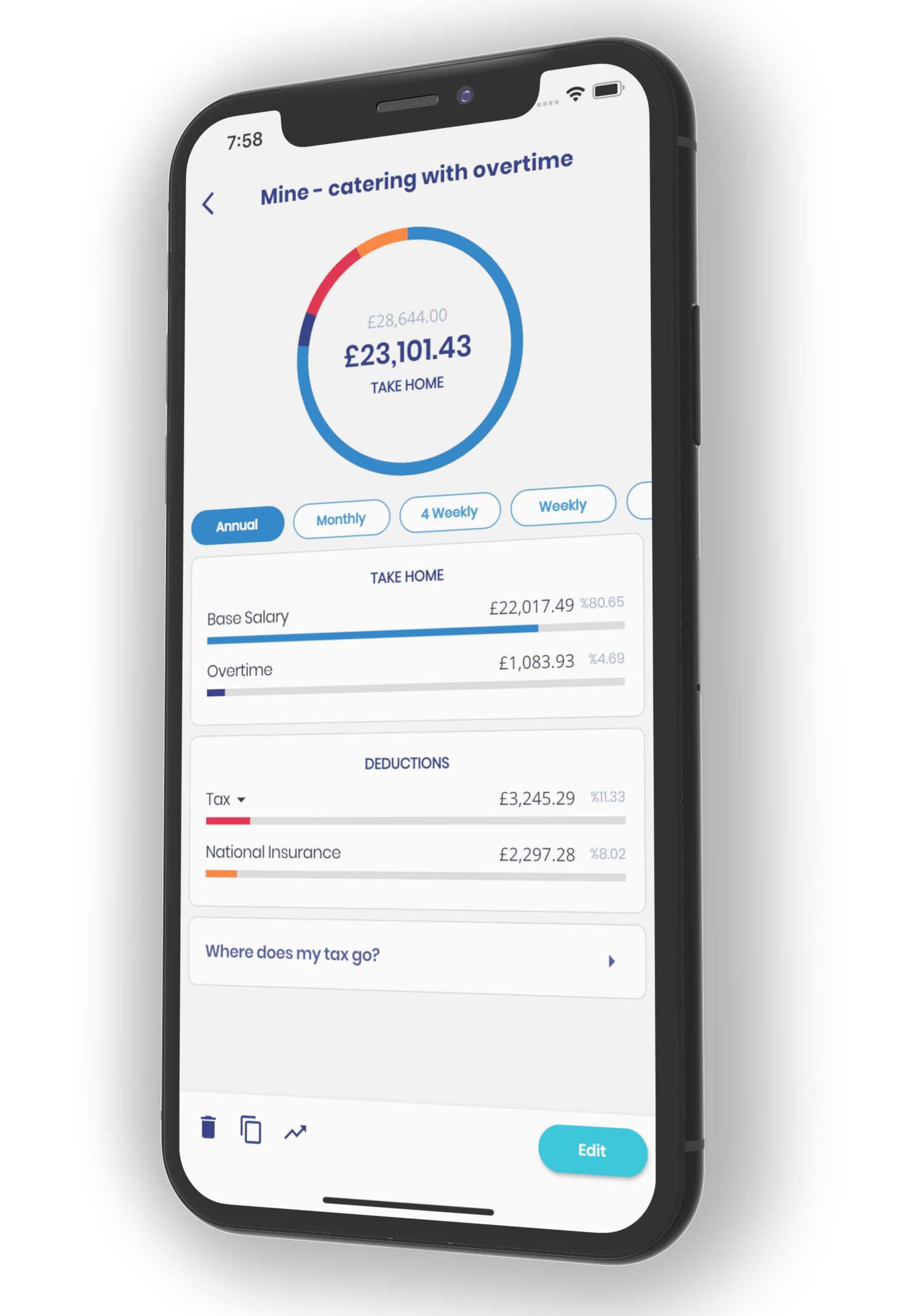

Salary calculator after tax uk. And your contract employer pays your salary to the umbrella company which then pays your net salary after calculating taxes. UK Income Tax Information. UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

The calculator will even automatically update. Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary. Estimate your Income Tax for the current year.

The amount of UK income tax you pay on your salary in a given tax year will depend on how much of your income is above your Personal Allowance limit and how much of your income falls in each of the income tax bands. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your. In the tax year 2019 2020 776138 after tax will provide you with a net monthly salary of 35208.

One of a suite of free online calculators provided by the team at iCalculator. SalaryBot will automatically check to see if youre being paid the minimum wage for your age group. The UKs income tax and National Insurance rates for the current year are set out in the tables below.

Free tax code calculator Transfer unused allowance to your spouse. Taxation in France Income Tax on personal income is progressive with higher rates being applied to higher income levels four tax brackets. The gross to net salary calculator below outlines the salary after tax for every level of gross salary in the UK.

See how we can help improve your knowledge of Math Physics. Youll then get a breakdown of your total tax liability and take-home pay. 2021 INCOME TAX LTD company registered in England No.

11 income tax and related need-to-knows. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

Want to check to see what that new job offer salary will be after tax. You can use the net salary after tax figures to work out how much your take-home salary is after all tax and National Insurance contributions have been deducted. In the UK the employer withholds your income tax and pays it to the tax.

The United Kingdom salary and tax section updated for 2021 tax year provides guides information and online calculators to help you calculate and understand the way tax and accounting systems work in the UK with supporting tax rates and thresholds. These include income tax as well as National Insurance payments. After tax - UK Salary Tax Calculator 40000 After Tax If your salary is 40000 then after tax and national insurance you will be left with 30840.

Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes national insurance and other deductions such as student loans and pensions. Low income earners salary less than 10084 EUR do not pay income tax but after this amount the tax grows until 45. Income tax calculator - Salary calculator - Tax calculator - Average salary UK - Take home pay calculator - Pro rata salary calculator - Net salary calculator - PAYE tax calculator - 20000 after tax - 25000 after tax - 30000 after tax.

Your total net yearly amount after tax and NI will be 422493 and your hourly rate will be 37315. Taxes in the UK. Check your tax code - you may be owed 1000s.

When you choose an umbrella company you are their employee deployed on your contract employer premises on paper. Like many countries the UK has a progressive tax system with tax being paid at different rates depending on how high your income is. Tax-free childcare Take home over 500mth.

Simply enter your details and well generate a full breakdown of tax national insurance pension and student loan repayments. Usually many umbrella companies are able to give you 75 to 85 of your contractor salary as net income. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below.

Marriage tax allowance Reduce tax if you wearwore a uniform. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Also known as Gross Income.

A new addition is the ability to compare two salaries side by side to see the difference made to your take home pay.

1 Income Tax Calculator Uk Salary Calculator 2016 Salary Calculator Income Tax Income

72 000 After Tax Salary Uk Is 49 086 Tax Income Tax Salary

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Salary Tax Calculators For Romania 2020 Salary Calculator Salary Calculators

Best Salary Tax Calculator Salary Calculator Tax Consulting Tax Refund

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Important Things In Your Payslips Need To Check In 2021 Payroll Template National Insurance Number Payroll Software

Uk Tax Calculator 2015 2014 2013 Salary Calculator 2013 Listentotaxman Paye Income Tax Calculator Payslip How Calculator Ideas Salary Calculator Repayment

Self Employed Tax Calculator Self Employment Success Business Financial Management

Hmrc Tax Refund Revenue Online Services

Ensors Chartered Accountants Accounting Salary Calculator Tax Table

If You Are Unsure Of How Much Amount You Will Get Monthly After All Tax Deduction Estimate You Re Monthly Ta Umbrella Insurance Accounting Accounting Services

34 000 After Tax 2021 Income Tax Uk

France Salary Calculator 2021 22

Bd Income Tax Calculator App Will Help You To Calculate Your Tax Income Tax Calculator App Tax

Post a Comment for "Salary Calculator After Tax Uk"