Gross Pay Ytd Calculator

This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. To continue with our example the answer would be 1000 gross pay each week times 52 weeks equaling 52000 for the year.

Year To Date Income And Salary Calculator

Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Hawaii paycheck calculator.

Gross pay ytd calculator. The paystubs keep track of various YTDs like regular earnings withholdings and other deductions along with gross pay and net pay. It can be used for the 201314 to 202021 income years. Mel karade rabba full movie hd punjabi download Toshiba recovery disc creator for windows 7 Solr example java code Remote connection download Edith piaf la vie en rose download mp3 New Zealands Best PAYE Calculator.

We provide payroll global HCM and outsourcing. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Use this federal gross pay calculator to gross up wages based on net pay.

To understand Gross YTD multiply your weekly gross pay times 52 weeks for the year. Assuming that there are six total pay periods until March 31st 2083 multiped by 6 is 12498. Simply enter your annual income along with your hours per day days per week work weeks per year to calculate your equivalent income.

Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. 30 8 260 - 25 56400. The adjusted annual salary can be calculated as.

Check Date Pay. YTD Deductions are the amounts that are deducted from the gross pay that is FICA-Medicare FICA Social Security Federal Tax and State Tax. ESI is calculated on 075 of Gross Pay Basic and LOP dependent allowances or 21000 whichever is lower Rules for calculating payroll taxes FY 2019 2020 Income Tax formula for FY 2019 2020.

Get Salary Spy. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. The Australian Salaries is on its way to becoming one of the largest salary surveys in Australia.

All bi-weekly semi-monthly monthly and quarterly figures. All calculators have been tested to work with the latest Chrome Firefox and Safari web browsers all are free to download. Values less than or equal to 1000.

Monthly Income Calculators Version. If an employee starts work on January 1 2020 for 1000 Gross before taxes and deductions paid semi-monthly the gross YTD on April 1 2020 will be 6000 1000 X 6 with 6 being the number of semi-monthly tax periods. Calculated figures are for reference only.

That product will be your Gross YTD and give you an annual number to work with. 10562413041 Income Calculation Guide. While there are 52 weeks in a year many employers give employees around 2 weeks paid vacation between the year end holidays and other regularly scheduled vacations.

Gross and Net Calculator. If you make 50000 per year your gross earnings per pay period are approximately 2083 or 50000 divided by 24. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Payroll calculator Calculate Your Net Pay Simply enter a per-period or annual salary amount and your W-4 information for Federal State and Local tax jurisdictions into the free Araize Payroll Calculator. A fantastic salary guide on what you should be earning -- in just a few clicks. Contact credit center for income variances questions and or precise figures.

Gross and net calculator. It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount. This calculator will help you to quickly convert your annual salary into the equivalent hourly income.

Now multiply your earnings per pay period by the number of pay periods until the current date. YTD Gross shows the total or gross income that is actually earned by the person for whom the pay stub is being made be it an employee or self-employed personnel. Summary report for total hours and total pay.

This is often the number of agencies use to determine individual qualification for various programs.

29 Free Payroll Templates Payroll Template Payroll Checks Free Checking

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Monthly Financial Statement Template Blank Personal Financial Statement Sba Monthly Financia Income Statement Personal Financial Statement Statement Template

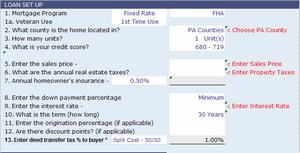

Income Annualiser Ytd Calculator Assured Lending

Between Dates Income Calculator Gross Wages And Work Stats

Businessmen Check Stub Template Workers And Normal People Who Use Checks For Daily Purposes Need To Maintain Proper Pay Stubs Template Pay Stub Pay Stubs

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Pay Stub Also Known As A Paycheck Stub Or Pay Slip Check Stub Pay Stub Paycheck

Create A Pay Stub Payroll Template Birth Certificate Template Payroll Checks

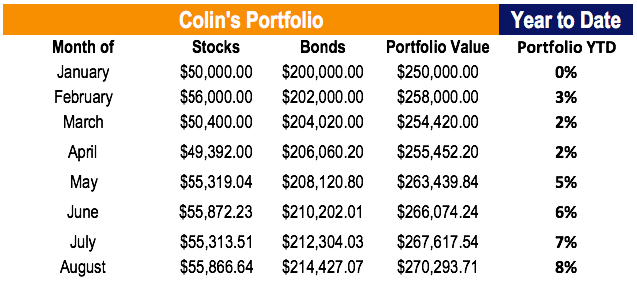

Year To Date Learn How To Calculate Ytd Figures Returns

Quick Easy W 4 Calculator Accounting Services Tax Small Business Accounting

Year To Date Learn How To Calculate Ytd Figures Returns

Hrpaych Yeartodate Payroll Services Washington State University

Year To Date Income And Salary Calculator

Lesson 19 Calculating Year To Date Profit Youtube

Post a Comment for "Gross Pay Ytd Calculator"