Net Salary Meaning

Net salary also referred as Take home salary is the amount which is left after deductions like PF EPS Advance etc. Although net salary is lower than the gross salary.

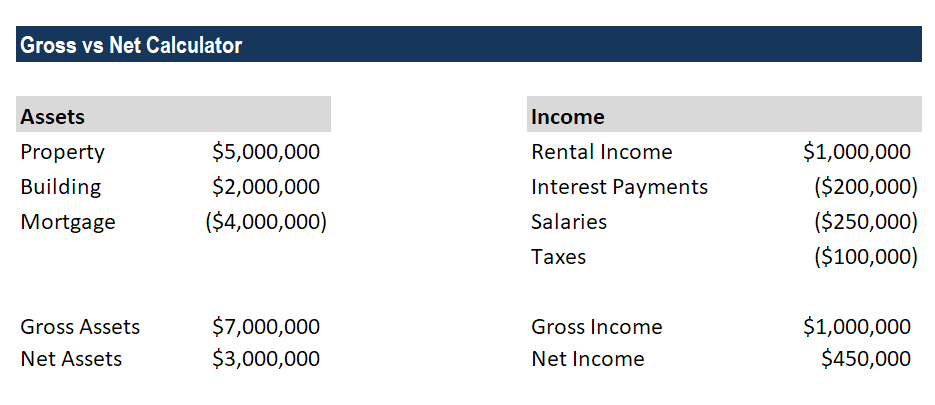

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross salary meaning What is gross salary.

Net salary meaning. A persons salary after taxes insurance etc. Is usually the Net Salary unless there are some personal deductions like loan or bond re-payments. The residual amount is then paid to the employee in cash.

Net pay is the amount of money that will finally be available to you. This is the total amount that gets credited to the bank account of the employee after all the deductions are done. The deductions that can be taken from gross pay to.

Salary Meaning - Age Net Worth. As the name suggests take home salary is the amounted that gets credited to your salary account every month. What is Net Salary.

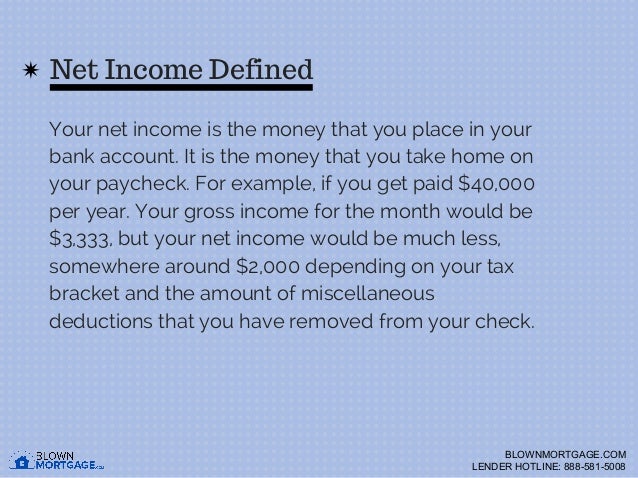

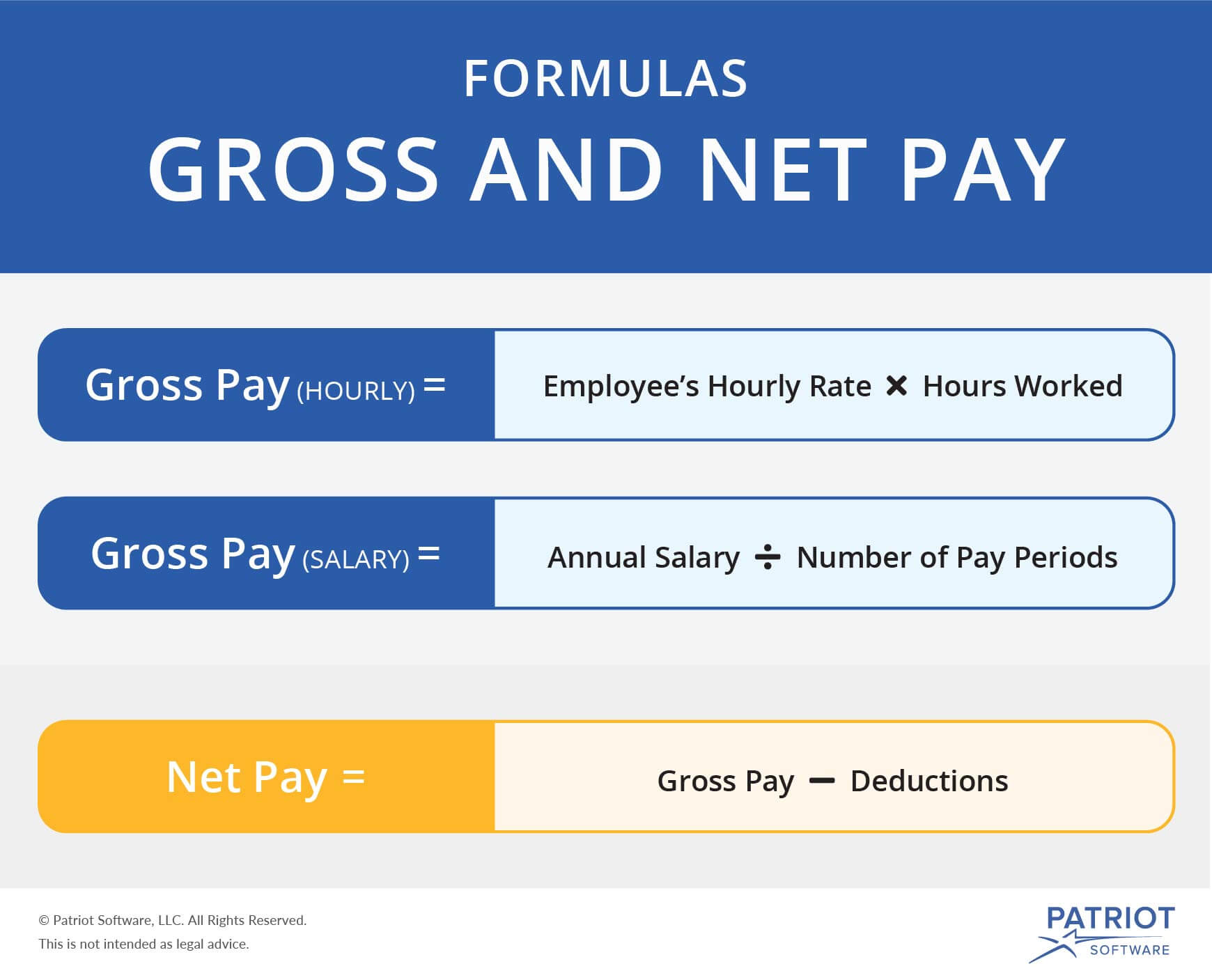

What is Net Salary Take home pay in-hand salary. Of salary or wages remaining after all deductions including taxes. For example if your employer agreed to pay you 2000 per hour and you work for 30 hours during a pay period your gross pay will be 60000.

A fixed amount of money agreed every year as pay for an employee usually paid directly into his or her bank account every month. Lets understand what gross salary is all about and how it is calculated. It refers to the in-hand figure that is calculated after deducting Income Tax at source.

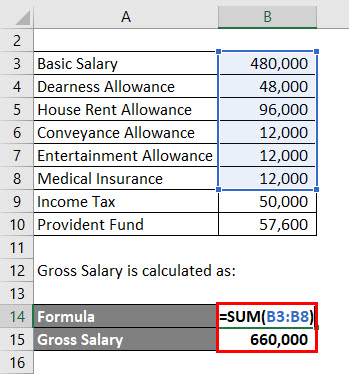

Remaining after all deductions. It is a reflection of the amount your employer pays you based on your agreed upon salary or hourly wage. Gross salary also called Cost to Company CTC is the total amount of salary that an employer pays an employee.

Using our last example if you earned 60000 in gross pay your net pay will be the amount that. Net salary more commonly known as Take-Home Salary is the income that the employee actually takes home once tax and other such deductions are carried over with. Net Salary is the amount of the employees salary after deducting tax provident fund and other such deductions from the gross salary which is generally known as Take home salary.

Take-home pay known as in-hand salary in India is the net salary after deducting income tax TDS tax deducted at source in India and other deductions from the gross monthly pay. Is what is left of your salary after deductions have been made. Gross Salary is the figure derived after totalling all the allowances and benefits but before deducting any tax while net salary is the amount that an employee takes home.

An annual salary of 40000 His net monthly salary is 2500. The gross salary is the actual salary that was promised to the employee but the net salary is the one that is being paid to him. For example if your employer agreed to pay you 15 per hour and you work for 30 hours during a pay period your gross pay will be 450.

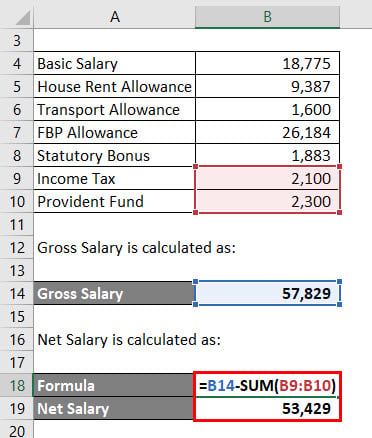

Net salary is the amount of take-home pay remaining after all withholdings and deductions have been removed from a persons salary. Net salary Gross salary Deductions In the above screenshot the difference of gross salary and deductions is Rs 23245 which is net pay. Clear of charges or deductions.

It includes all the allowances and perquisites provided by the employer. Net salary also known as take-home salary is the amount of money that you will receive after all. Is the amount of salary paid after adding all benefits and allowances and before deducting any tax.

Different types of salary Gross Salary. Net pay is the final amount of money that you will receive after all taxes and deductions have been subtracted. Its given by the employer after deducting taxes and other deductions such as public provident fund professional tax.

An employees salary is divided into two main parts gross salary and net salary. Net salary is the total salary one gets after all the mandatory deductions such as taxed that are made from the total gross salary. Net Salary or Take Home Salary.

Meaning of net salary Net salary is said to be the physical amount that the employee gets his hands on and is exclusive from other fringe benefits. Net Salary is the actual take away home salary that an employee gets in its bank account. Exclusions Retirement Benefits eg 401k benefits Income Tax which deducts at source Shift Allowance Free Meals if any.

What Is Annual Net Income Mintlife Blog

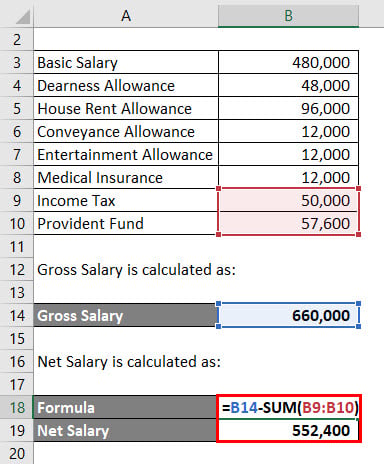

Salary Formula Calculate Salary Calculator Excel Template

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Gross Vs Net Income Which Should You Consider

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

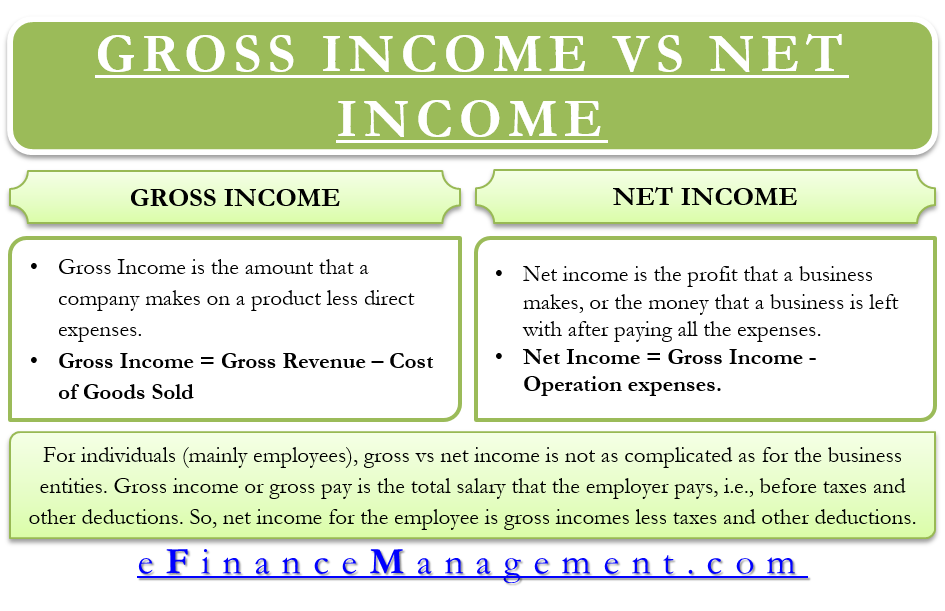

Difference Between Gross Income Vs Net Income Definitions Importance

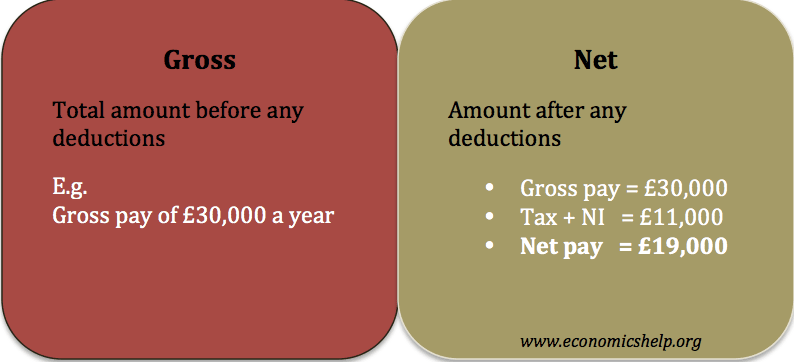

The Difference Between Gross And Net Pay Economics Help

What Are Gross Salary Monthly Deductions

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Vs Net Learn The Difference Between Gross Vs Net

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Do Net Income And Operating Cash Flow Differ

Operating Income Vs Gross Profit

Difference Between Take Home Salary Net Salary Gross Salary Ctc

Post a Comment for "Net Salary Meaning"