Salary Calculator Wisconsin

2021 salary paycheck calculator usage instructions. The average Accountant I salary in Wisconsin is 55317 as of June 28 2021 but the range typically falls between 50359 and 60904.

Wisconsin Income Tax Brackets 2020

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Salary calculator wisconsin. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin. To calculate a salaried employees. Similar to the calculation of federal income tax Wisconsin income tax can be worked out in 5 simple steps.

Use our calculator to discover the Wisconsin Minimum Wage. Our free Wisconsin salary paycheck calculator is a tool that no growing company should be without. The Income Tax calculation for Wisconsin includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Wisconsin State Tax Tables in 2021 Federal Tax Calculation for 9000000 Salary 9000000 Federal Tax Calculation The table below details how Federal Income Tax is calculated in 2021.

Your household income location filing status and number of personal exemptions. The results are broken up into three sections. Total Estimated Tax Burden 18593.

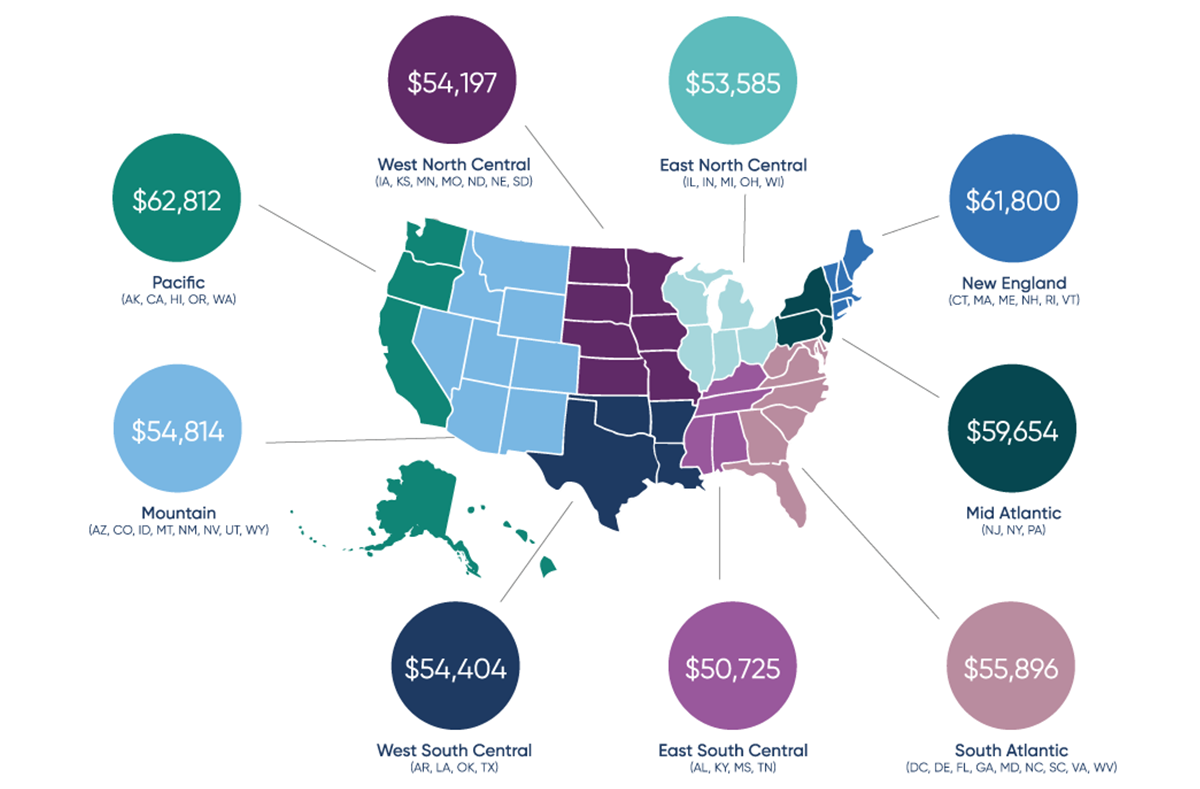

The Wisconsin Minimum Wage is the lowermost hourly rate that any employee in Wisconsin can expect by law. Compare the Cost of Living in Madison Wisconsin against another US Cities and States. Wisconsin Salary CalculatorInform your career path by finding your customized salary.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. Figure out your filing status. Wisconsin fiscal year starts from July 01 the year before to June 30 the current year.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. The assumption is the sole provider is working full-time 2080 hours per year. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The Wisconsin Salary Calculator allows you to quickly calculate your salary after tax including Wisconsin State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Wisconsin state tax tables. In the case of households with two working. Created with Highcharts 607.

Using our Wisconsin Salary Tax Calculator. The tool provides information for individuals and households with one or two working adults and zero to three children. Fast accurate to the cent and incredibly easy to use this software serves one purpose and one purpose alone.

Wisconsin Paycheck Calculator Your Details Done Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs. See what youll need to earn to keep your current standard of living wherever you choose to work and live. There are legal minimum wages set by the federal government and the state government of Wisconsin.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Salary ranges can vary widely depending on the city and many other important factors including education certifications additional skills the number of years you have spent in your profession. Percent of income to taxes 33.

To use our Wisconsin Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Hopefully this guide has helped you to understand your salary and the federal and state taxes you need to pay on it.

The federal minimum wage is 725 per hour and the Wisconsin state minimum wage is 725 per hour. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. To help get your people get paid accurately and on time with the least possible effort on your end.

Bonus Example A 1000 bonus will generate an extra 639 of net incomes. This calculator can be helpful if you want to compare your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term. Work out your adjusted gross income Total annual income Adjustments Adjusted gross incomecalculate your taxable income Adjusted gross income Post-tax.

Wisconsin Salary Paycheck Calculator Results Below are your Wisconsin salary paycheck results. Wisconsin Salary Paycheck Calculator. Living Wage Calculation for Wisconsin.

On a gross salary of 220646 you will have a net salary of around 14848496 in Wisconsin and between 13942839 and 16122813 if you were to file in another state. One of a suite of free online calculators provided by the team at iCalculator. In order to determine an.

Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator. After a few seconds you will be provided with a full breakdown of the tax you are paying. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin.

Wisconsin Salary Calculator 2021 Icalculator

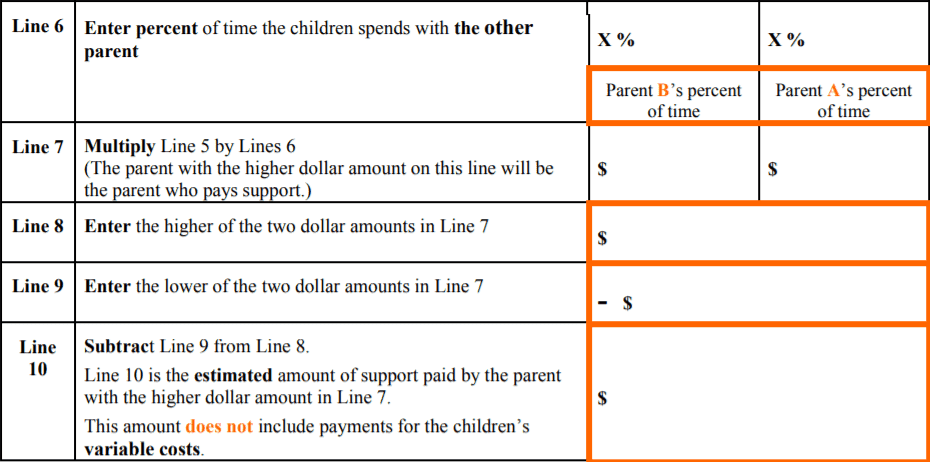

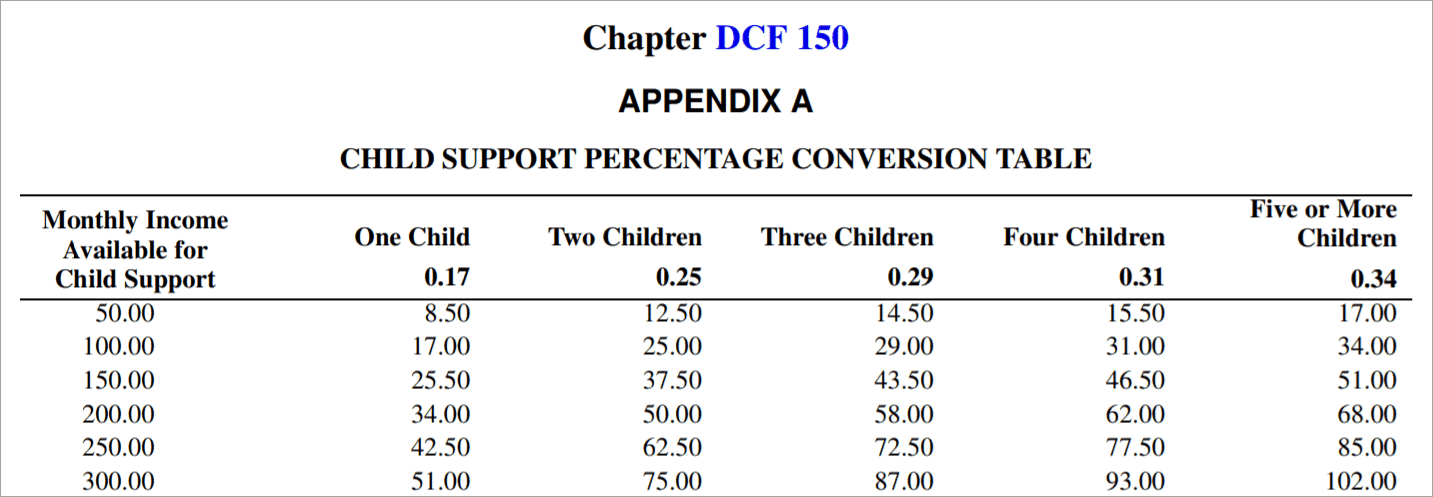

Wisconsin Child Support Overview How It S Calculated More

Plain Wisconsin Wi 53577 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New London Wisconsin Wi 54961 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

This Is How Much Money You Save On H1b L1 Visa In Us 2021

Wisconsin Child Support Calculators Worksheets 2021 Sterling Law Offices S C

Lunch Break Rest Period Labor Laws In Wisconsin Minimum Wage Org

Wisconsin Income Tax Calculator Smartasset

Health Insurance Marketplace Calculator Kff

Average Medical College Of Wisconsin Salary Payscale

Wisconsin Salary Paycheck Calculator Paycheckcity

Seven Things About Salary Calculator You Have To Experience It Yourself Salary Calculator Salary Calculator Salary No Experience Jobs

Wisconsin Paycheck Calculator Smartasset

Best Wisconsin Colleges With No Application Fee Niche

Wisconsin Paycheck Calculator Smartasset

Wisconsin Child Support Overview How It S Calculated More

Wisconsin Payroll Tools Tax Rates And Resources Paycheckcity

Medical Coding Salary Medical Billing And Coding Salary Aapc

Post a Comment for "Salary Calculator Wisconsin"